Freelancers across the world work with just one goal in mind – ‘to get paid’. In order to successfully do so, they have to pick the right option from several available payment methods. So what’s the best method to get paid as a freelancer?

- How to get paid as a freelancer: payment alternatives

- PayPal

- Skrill

- Google Pay

- Escrow

- EFT

- Wire transfer

- Checks

- Debit/credit cards

- Wise

- Stripe

- Paymo

- Western Union and MoneyGram

- Payoneer

- Accounting software

- What should you consider when choosing how to get paid?

There are several aspects to consider when deciding on a way to accept payments.

- Do you prefer online or offline payment services?

- Which payment platform do you find reliable?

- What methods are commonly used by other freelancers?

- And last but not least, what amount of fees are you willing to pay?

To help you answer these questions, we’ve compiled a list of some of the most popular ways to get paid as a freelancer when working online, explaining their advantages and disadvantages in brief.

How to get paid as a freelancer: payment alternatives

1. PayPal

One of the most popular payment options amongst freelancers, PayPal is a fast, easy and extremely reliable method to receive payments. A nominal fee per transaction is charged from the seller, which may be higher or lower based on the account type.

What’s the best PayPal account for freelancers?

You can start with a personal account that can later be upgraded to a business one. Transaction fees vary depending on where you are based and might also be higher for cross-border transactions (currency conversion fee).

| Country | % Transaction | Fix fee |

|---|---|---|

| U.S | 2,9% | USD 0,30 |

| Spain | 3,4% | EUR 0,35 |

| The Philippines | 3,2% | PHP 15 |

Pros and Cons of PayPal

The biggest advantage of PayPal is its popularity as well as the fact that customers are much less likely to hesitate when using it. Additionally, PayPal allows customers to make purchases directly through your website and accept credit card payments by phone, fax, or mail, as long as you have a business account.

The downside? High transaction fees and sometimes unsatisfactory customer service.

Also, note that PayPal has the right to lock your account if they notice any “suspicious” activity. This means your transfers can be frozen or your funds may not be available for a while.

2. Skrill

Formerly known as Moneybookers (2001), Skrill focuses on worldwide transfers in different currencies. It is a worthwhile option for those who tend to work with international clients regularly. In terms of fees and charges, it is quite similar to PayPal.

Pros and Cons of Skrill

Skrill is an easy to use payment gateway which is pretty secure and gives fast access to its users. On the flipside, Skrill is still not widely accepted as a payment option in many countries.

3. Google Pay

In 2018, Android Pay and Google Wallet unified to become Google Pay. It is one of the simplest ways for freelancers to receive and send money online. The best part? There are no transfer fees.

Google Pay Pros and Cons

Google Pay offers a multitude of benefits such as zero fees, the convenience of transfering money from your bank account to any account, and rewards that go directly into your bank account. The only negative thing about this method is that it has limited online payment partners.

4. Escrow

When it comes to security of online payments, Escrow is perhaps the best option for freelancers. To safeguard the interests of both parties, this method first requires the client to deposit the payment before the seller begins working on a project.

The seller gets confirmation and is assured of secured funding. Once the client confirms that they have received the service, the seller receives the payment. There is a transaction fee of 3.25% which can be split between the two parties.

Pros and Cons of Escrow

Escrow is an ideal payment option for those who work with new clients regularly. However, the service fee is on the higher side.

5. EFT

Electronic Funds Transfer (EFT) is a way of transferring funds from one account to another with or without a nominal fee.

Pros and cons of EFT

It is quick, easy, and you receive payment directly into your bank account. On the flipside, the disadvantages of EFT are the various limits on the maximum amount and the number of transactions that can be done.

6. Wire transfer

A type of EFT, wire transfer is a bit faster costs a bit more.

Wire transfers are undoubtedly safe, fast and globally accepted; these transfers are irrevocable too. Wire transfers regularly take between 2 to 5 business days to be completed. Another added benefit is that the freelancer can have the money deposited directly into their account. A major negative, however, is that wire transfers do tend to be rather expensive.

7. Checks

Getting paid by a check is a traditional offline payment option. We would suggest reserving this method only for clients that you trust, and if you can, wait for the check to be processed.

Pros and cons of checks

While checks are virtually free and highly convenient, they do take a bit longer to process than most other payments methods. So if you find you need to be paid as soon as possible, this is probably not the method for you.

8. Debit/credit cards

While not conventionally used for overseas payment, some clients prefer to pay their freelancers with plastic. Even though card processing equipment may be required to accept payments through this method, freelancers usually make use of apps or other service providers to receive payment.

Pros and cons of getting paid with debit or credit cards

Although cards allow your clients to pay you in just a few clicks, they may be expensive for large payments. To be able to accept payments by credit card you will probably also need to pay for another service provider, such as PayPal or QuickBooks.

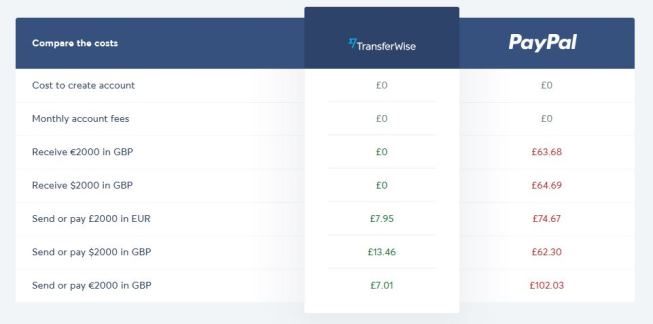

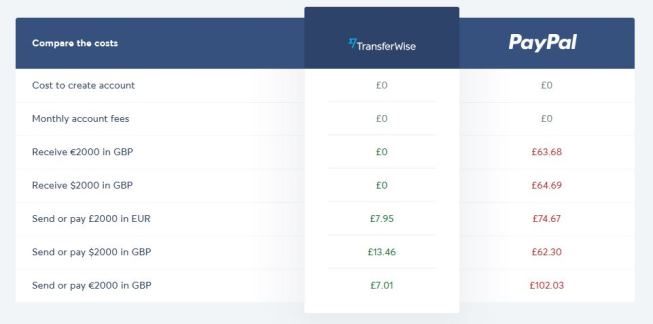

9. Wise

Wise, previously known as TransferWise, is an ideal choice for freelancers who often request large payments and work with overseas clients. It transfers money at real exchange rates with no bank fee involved.

Pros of receiving payments with Wise

- A borderless account allows freelancers to receive money in over 40 currencies

- Real exchange rates on different currencies

- Receive money without fees

- No cost for opening an account

- Get a debit card (Mastercard) associated with that account

- Multilingual online support

>> Find out how Wise can help freelancers

10. Stripe

Another payment method that’s gaining traction amongst freelancers, Stripe charges a standard fee of 2.9%, plus a $0.30 per transaction fee.

Pros and cons of Stripe

Stripe is quick to set up and highly secure, its high transaction costs, being maybe a freelancers’ only gripe.

11. Paymo

Besides helping you receive payments without a fuss, Paymo does a great job of helping you keep track of multiple projects. Freelancers also get to enjoy a free plan.

Pros and cons of Paymo

This payment platform comes with a fairly intuitive dashboard and helps with scheduling and reporting too. On the other hand, the built-in invoicing feature is a bit difficult to customize and can prove to be a hindrance to some freelancers.

12. Western Union and MoneyGram

Both of these methods are quick, convenient and globally accepted. While Western Union has over 500,000 locations worldwide, MoneyGram has around 350,000.

In terms of fees, Western Union rates start at $5 and can go up to $45 when paying by credit or debit card for cash pickup in some of the supported countries. Fees charged by MoneyGram, on the other hand vary depending on how much money is being transferred, and how and where it is being sent to.

These freelancer payment options are reliable, secure and have a wide reach. But MoneyGram’s exchange rates and transaction limits make it a bit less favorable than other payment methods.

Browse the latest projects and work without commission fees

> Start on a project now

13. Payoneer

Payoneer is quickly gaining international popularity for being an easy-to-use payment method. This platform lets you withdraw funds and deposit in your local bank account, and is available in over 200 countries and rising.

Pros and cons of Payoneer

Payoneer is incredibly easy to use and is supported by several global companies as a payment method. It is important to note, however, that this method comes with a hefty card renewal fee.

14. Accounting software

While this may not technically be a payment method, using accounting software is a great way to automate and keep track of your incoming payments for clients, especially if you’re working on multiple projects at once!

These programs keep track of invoices issued, payments to be made, and even notify clients about overdue payments.

Accounting software collecting payment for freelancers

You’ll find several accounting software options to use. These range from global accounting software packages to smaller software companies operating locally.

Here are a few of the best accounting programs created especially with freelancers in mind.

Any of these platforms can be useful when trying to organize payments.

What should you consider when choosing how to get paid?

- Fees: As a freelancer, pay due diligence to your chosen gateway’s fee structure.

- Convenience: In order to avoid delayed payments, ensure that your chosen payment method is easy for your client to use.

- Support: Look for a payment service provider that offers live technical support to take care of any issues that may arise.

- Security: For absolute peace of mind, always choose a secure and established channel to receive payments.

- Brand: Popular payment service providers have a known presence across the world. If you are a freelancer who receives international payments, pick a brand that has a worldwide presence.

And that’s it!

Tell us about the payment methods that you’ve personally used when working on web projects. Leave your comments below and share your experience with the world!

Thanks for letting us know about How to Open Paypal Account.

How much time does it take to withdraw money from freelancer?

Hi Abhishree, there is no general rule. It mostly depends on the financial institutions and the service you are using.