Freelancers, especially at the beginning of their career, are very reliant on cash flow – how much money comes in and how quickly it does so. This is a factor that will make or break businesses. One of the ways freelancers can speed up their cash flow is invoice factoring.

This article explains what this financing method includes, how it can benefit you and what risks it often hides. If your clients take a lot of time to pay off invoices and you feel like increasing your cash flow is a priority to your business right now, keep reading.

- What is invoice factoring?

- Pros and cons of invoice factoring

- Invoice factoring companies for freelancers

- Factoring as an alternative financing method

What is invoice factoring?

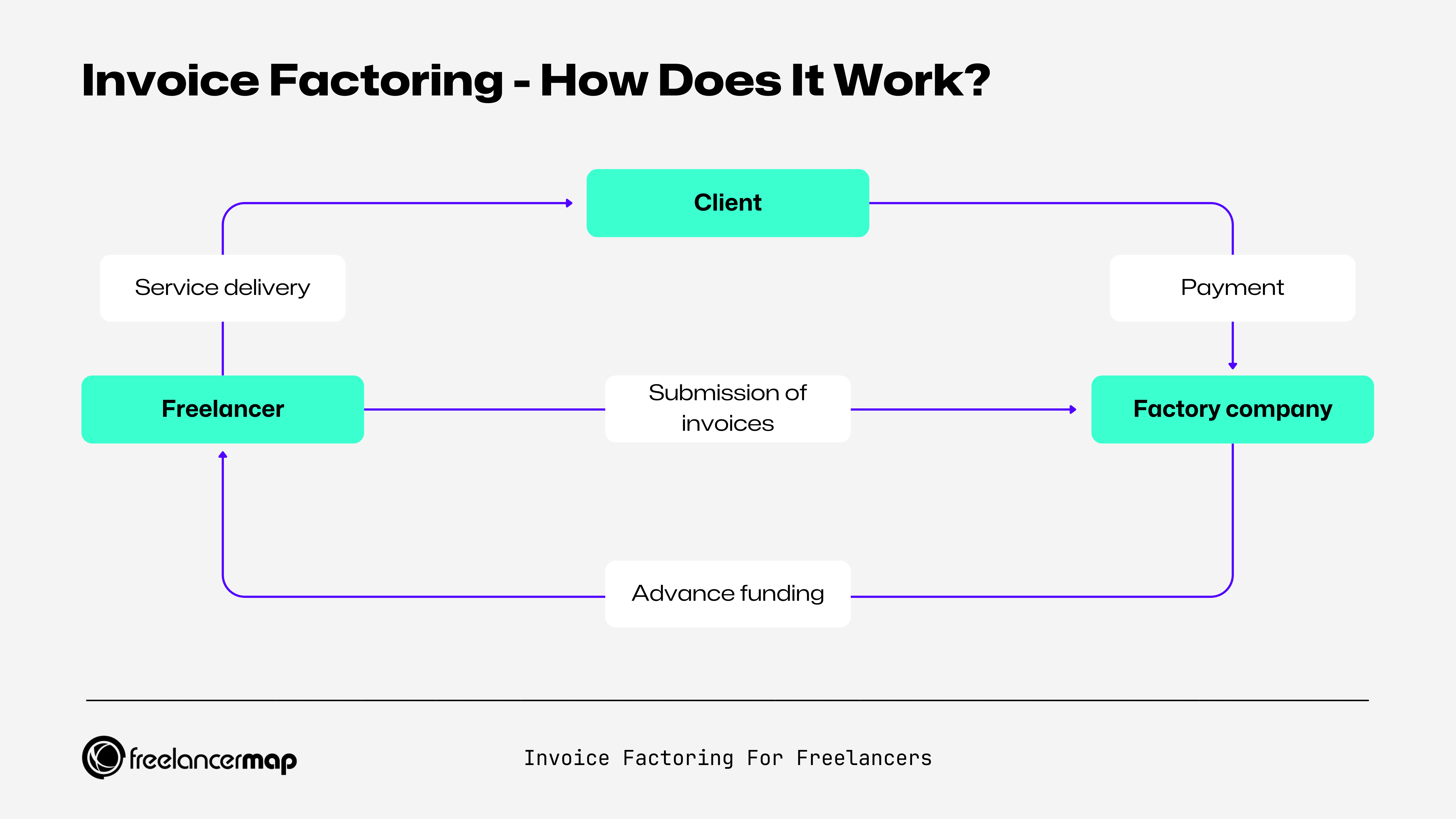

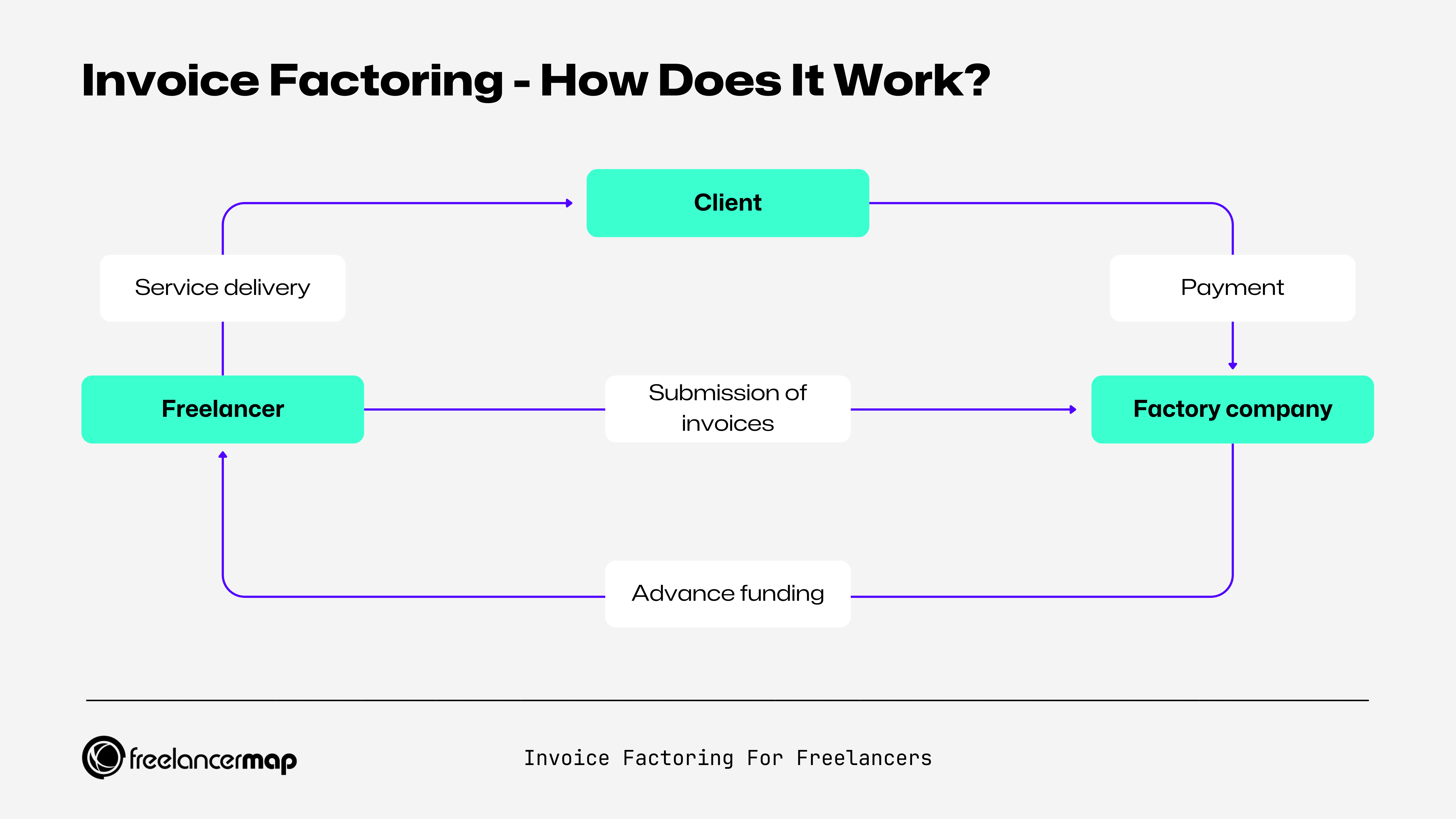

Invoice factoring is a way to get your invoices paid up to a certain percentage right away. You sell your invoices to a finance provider who will cash them out and pay you anywhere around 70 and 90 percent of their worth. After the invoice is actually paid by your client, you get the rest of the sum minus their interest rates (between 1,5% and 3,5%).

Using invoice factoring means you don’t have to wait weeks or sometimes even months to get your money, but you have to give up a part of your income in return.

Freelance factoring: Am I a good fit?

Invoice factoring is ideal if you are having cash flow problems with your small business as a result of unpaid invoices.

For example, if you own a freelance business and have just completed a project for one client, creating an invoice of $3,000 to be paid within 30 days, you now have the time to now take on another project, but you need the cash to cover your living expenses, software, and general business running sooner than 30 days. This is a cash shortfall.

Enter invoice factoring, which means the factoring company will buy your invoice, and send you a percentage in advance (around 85%), and the remaining amount minus a processing fee when the invoice is paid off. This provides you with the cash you need in advance of your client actually paying the invoice.

Invoice factoring companies will check the creditworthiness of your client first and if everything is fine will send you the payment your end. You will be a good fit for invoice factoring if you clients don’t have a bad credit rating.

Here’s an invoice factoring example:

| Invoice amount | $3,000 |

| Factoring fee (2,5%) | $75 |

| 1st Advance (80%) | $2,340 |

| 2nd Advance (17,5%) | $585 |

| Total received | $2,925 |

If you often have cash shortfalls, invoice factoring could be a great fit for you. However, if you have regular clients who pay on time, allowing you to cover your business costs throughout the month, you may not need to rely on invoice factoring and lose a percentage of your money.

Now that we know what invoice factoring is, let’s look at some other, perhaps less obvious, pros and cons.

Pros and cons of invoice factoring

| Pros | Cons |

|---|---|

| Faster Payment | Can be an expensive service |

| Increased cash flow | There’s no absolute guarantee of collection |

| Unsecured financing (i.e. no collateral is required) | You lose control over your invoices and how you deal with your clients |

| Takes admin & back office responsibilities off your hands | Some contracts are only available on a long-term basi |

Benefits

The first advantage that we already mentioned is getting money quickly.

That aspect alone brings a couple of benefits to the table. First of all, you can plan out your financial strategy more efficiently, knowing that you don’t depend on a client paying you early or late. This in turn allows for quicker investments and, in the best case scenario, rapid growth.

Other than that, factoring can help you research your clients and thus avoid potentially bad ones. The firms that are willing to lend you the money will often want to look up who you work with and sometimes flat-out refuse to work with someone that they suspect can delay or not make the payment at all.

Risks

Factoring can come at a price, and no, we’re not talking about the interest fees that factoring providers will cost you. Unfortunately, factoring sometimes comes with the stigma that it is primarily used by businesses that are struggling, which isn’t always the case.

With that being said, the worst potential drawback is the damage it can cause to the business relationship with your clients. Some companies will prefer the personal touch and dealing with you – for them, those preferences might be the exact reason why they chose to work with a freelancer in the first place. Others will just be straight out annoyed when a third party starts calling them with reminders to pay an invoice.

Last but not least, some factoring providers will want to have a say in the way you operate your business. What they see as a potentially bad client might be someone you’re willing to do the work for anyway for a variety of reasons.

Factoring companies for freelancers

Not all invoice factoring companies are ideal for small businesses and freelancers. There are a few things that it is sensible to watch out for before you select your invoice factoring company. These include:

- Contract length: Some invoice factoring companies want to tie you into a long-term contract, which may not be ideal for a freelancer either because of the irregularity of your work, or because you want to use this financing method as more of a short term solution. Read your finance contract carefully to make sure you are not being locked into anything long-term without realizing.

- Fees & rates: Invoice factoring companies take a processing fee from your invoice in return for buying your invoice. Make sure all of these fees are transparent and clear so you know exactly how much you, and your invoice factoring company, will receive from each invoice.

- Understand the notification process: As we’ve said, one of the biggest risks to invoice factoring is potentially alienating your clients. Make sure you know how the notification process will work between the company and your client, and consider being a part of this process in the beginning to ensure the transition goes as smooth as possible.

A few highly rated invoice factoring companies for freelancers that you might like to consider include:

Conclusion

To sum it up, factoring might be worth it for freelancers who can use the quick cash flow in a smart way to grow and nurture their business. However, you should be aware of the risks and research the agreement you’re going to have with the factoring providers before you jump into anything.

Thankfully, it’s quite the competitive market and there will be a lot of offers to choose from.