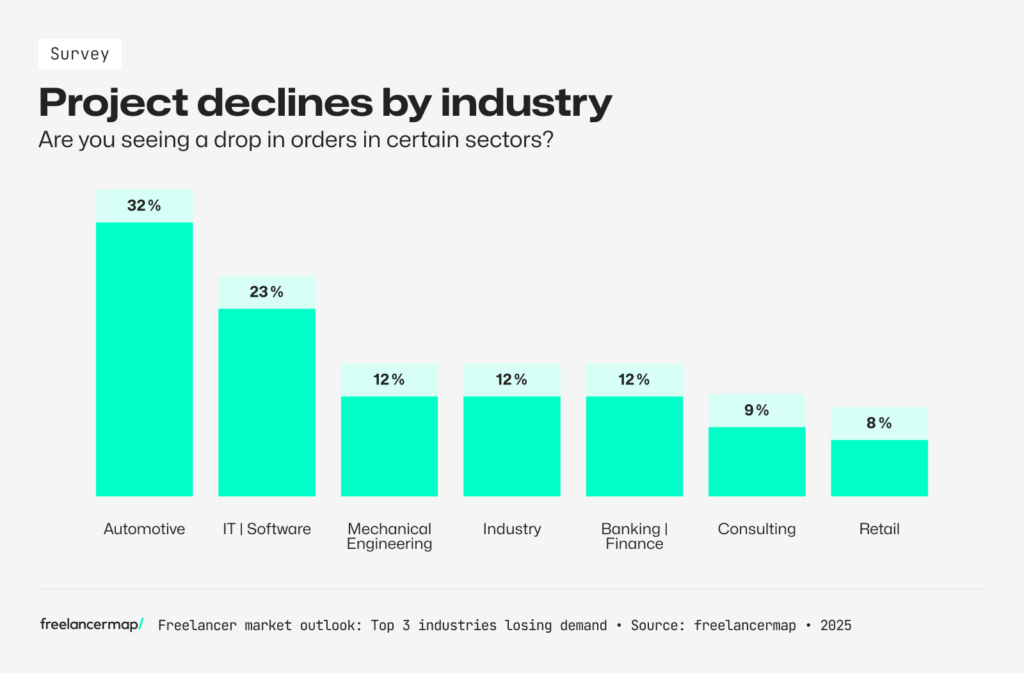

The challenging economic climate has left its mark in 2025, affecting both companies and freelancers. But which sectors are bearing the brunt? Our latest data from the Freelancer Compass 2026 reveals the three industries experiencing the most significant decline in projects in the DACH region.

- Key takeaways

- Top 3 industries losing demand

- Automotive industry in crisis

- IT/Software as second-largest loser

- Project decline in Mechanical Engineering

- Where were freelancers primarily active?

- Conclusion: What the 2025 project market means for freelancers

Key takeaways

- Automotive, IT/Software, and Mechanical Engineering are 2025’s most affected industries for freelancers.

- 32% of freelancers report project declines in the automotive sector.

- IT/Software sees 23% fewer projects; Mechanical Engineering experiences 12% decline.

- Main drivers include weak economic conditions, falling exports, and geopolitical uncertainties.

- Despite challenges, IT/Software remains the top employment sector for freelancers at 33%.

The industries losing ground in 2025

freelancermap surveyed over 1,300 freelancers for the upcoming Freelancer Kompass 2026, a freelancer study that has provided the most comprehensive data on freelancing in the German-speaking region for over ten years.

The results clearly show the industries that were hit the hardest this year:

- Automotive: 32%

- IT/Software: 23%

- Mechanical Engineering: 12%

The automotive industry, as well as the IT and software sectors, have been struggling for some time now. Mechanical engineering is also facing significant challenges. Following closely behind are industrial manufacturing and banking/finance. Consulting, as well as retail and consumer goods, are affected at 9% and 8% respectively.

These declines stem from Germany’s weak economic performance, compounded by geopolitical shifts such as trade disputes with the United States.

Automotive industry in crisis

It’s no surprise that automotive leads the list of declining sectors. The industry faces unprecedented economic pressure.

According to EY’s Industry Barometer, the automotive sector lost approximately 51,507 jobs from Q2 2024 to Q2 2025 (a nearly 7% decline). Simultaneously, automotive revenue dropped by 1.6%.

This downturn directly impacts the 32% of surveyed freelancers who report noticeable project declines.

This figure far exceeds freelancermap’s average year-over-year project decline of 5.9%. Companies are cutting costs, and external specialists are often the first to go since these contracts can be terminated more easily than permanent staff positions.

Why this sector is struggling

The automotive industry’s challenges are both structural and cyclical:

- Weak sales, intense competition from China, and costly transitions to electric mobility

- High energy prices and bureaucratic hurdles

- Trade disputes with the US making German exports significantly more expensive

Major companies are responding with drastic measures:

- Mercedes-Benz and VW announce comprehensive cost-cutting programs

- Bosch and Continental reduce production capacity

- Porsche largely discontinues its battery subsidiary Cellforce

Freelancers feel these austerity measures immediately. When companies reduce expenses, external project work is typically the first casualty.

The reality: Half of freelancers report worse project conditions compared to last year, and 43% of respondents have no secured workload. Only a quarter of freelancers have planning security beyond three months.

“When so many industries experience project declines and nearly half of freelancers have no planning security, this is no longer an individual risk but a structural problem. Freelancers represent flexibility and expertise. Yet these very professionals are increasingly under pressure because economic and political conditions make their work more difficult. — Thomas Maas, CEO of freelancermap

Despite declining project demand, 14% of surveyed freelancers worked in automotive or consulting. Even with reduced demand, the field remains relevant for self-employed professionals.

IT and Software as second-largest losers

At 23%, the second-largest freelancer group experiences noticeable declines in IT. This affects an industry that has long been considered stable and secure.

Many IT professionals are active on freelancermap, making the project decline particularly noticeable. Yet the IT sector remains the largest client on the platform. The majority of respondents (33%) worked primarily in IT and software in 2025.

This means: While project declines are tangible, self-employed specialists remain in demand. According to a Bitkom study, the German economy currently lacks 109,000 IT professionals.

However, 26.2% fewer open IT positions were posted within a year, according to a study by the Institute of German Economics (IW) — representing 16,500 fewer positions in absolute terms.

Reasons for the Decline

The IW attributes the decline primarily to weak economic performance. Economic uncertainty leads many companies to postpone or cancel investment projects entirely.

This directly affects IT projects and demand for external specialists. Simply put: when budgets shrink, IT projects are often the first to be postponed or eliminated.

Where demand Is booming: AI as a market exception

However, not all areas are affected equally. Demand in the AI sector is surging. The need for AI developers and engineers jumped from nearly 60 project listings in 2024 to around 200 in 2025.

The trend is even more pronounced across all AI-related listings: 159 projects sought AI expertise on freelancermap in 2023, growing to 453 in 2024 and 1,091 in 2025. This represents growth of over 530% in just three years.

While traditional IT projects are declining in many areas, AI holds the potential to become one of the most important growth drivers in the coming years. Freelancers can leverage this by focusing on specialisations, pursuing further education, and riding emerging trends.

Are you an AI expert?

Join our community today and discover exciting AI projects waiting for you!

Project decline in Mechanical Engineering

Mechanical engineering is also directly impacted by the precarious economic situation. This has consequences not just for companies themselves, but for everyone dependent on industry-specific projects. 12% of surveyed freelancers report experiencing significant project declines in this sector.

The latest EY industry analysis shows that the employment decline has accelerated significantly since Q2 2024. Mechanical engineering is among the hardest-hit sectors, with approximately 17,400 positions lost compared to the previous year, one of the largest workforce reductions within German industry.

Reasons for the decline

The sharp downturn in mechanical engineering can be explained by several factors:

- Weak industrial economic conditions reduce production and demand, directly translating to fewer freelancer projects

- Many client industries, especially the struggling automotive sector, are holding back investments, resulting in fewer machine and equipment orders and less need for external support

- Critical export markets are collapsing: according to VDMA, exports declined by nearly 5% in the first half of 2025

- Global uncertainties, such as trade disputes with the US, intensify this development as companies plan more cautiously and cut budgets

Freelancers working in mechanical engineering often feel these cuts directly: projects are cancelled, budgets are reduced, and external support is commissioned less frequently.

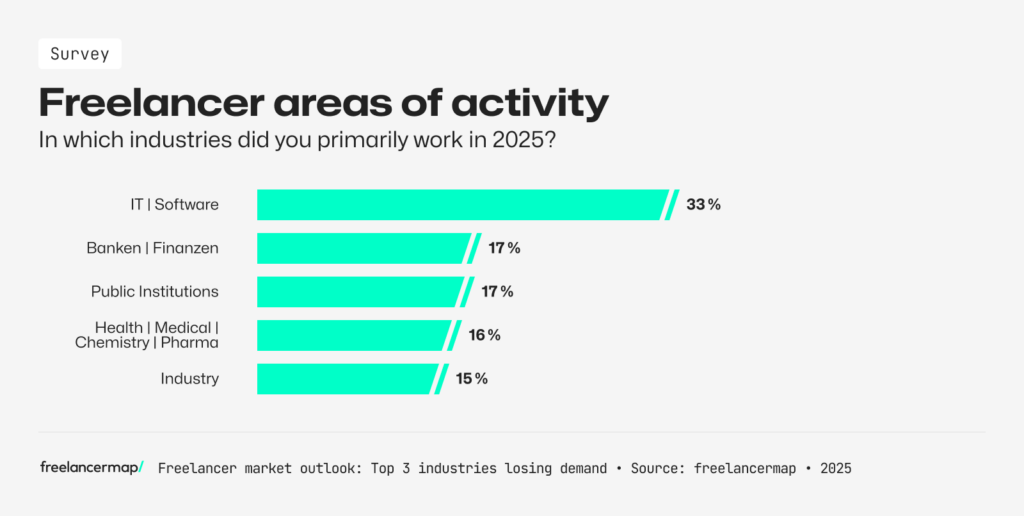

Where were freelancers primarily active?

Despite significant project declines in IT and software, this sector remains one of the areas where freelancers are most frequently engaged, according to the Freelancer Kompass 2026.

The data shows:

- 33% of freelancers worked primarily in IT or software projects in 2025, by far the largest employment field for freelancers

- 17% worked mainly in banking and finance, as well as government and public institutions, both of which formed the second-largest activity areas in 2025

- 16% of freelancers were active in healthcare, medicine, chemistry, or pharmaceuticals

- 15% worked in industrial manufacturing, which remains an important client despite challenging economic conditions

- 14% worked in automotive or consulting, demonstrating that despite parallel project declines, demand for external specialists persists

Other relevant industries include retail and consumer goods (12%), mechanical engineering and energy (10% each), transportation/logistics, telecommunications, and insurance (7% each).

The fewest freelancers work in real estate and aerospace (3% each) and tourism (2%).

What Freelancers Can Take Away

What can we conclude? Despite economic uncertainty, the freelancer market is strongly shaped by IT, the financial sector, public administration, and healthcare. Those who specialise across different industries and maintain a broad positioning have the best chances for relatively stable project flow.

The market appears to be recovering slightly. While conditions remain tense, a modest upward project trend is emerging. November and December have stabilised compared to the annual average and the volatility of recent years.

Conclusion: What the 2025 project market means for freelancers

Economic pressures have significantly reshaped the project landscape for freelancers and self-employed professionals. Industries like automotive, IT/software, and mechanical engineering are among the hardest hit.

Many companies are cutting budgets, postponing investments, and prioritising internal projects over external ones when looking to save costs.

Despite this, IT remains one of the main fields where freelancers are active, and the automotive sector continues to be a key client in the DACH region.

For freelancers, the message is clear: demand is declining, but it hasn’t disappeared. In some areas, companies still face shortages of skilled specialists. Freelancers with broad positioning or those working in less volatile sectors enjoy more stable opportunities.

AI stands out as a major exception. Freelancers who adapt to the right trends and develop relevant skills can benefit from one of the fastest-growing areas of demand.

The bottom line from this survey: The market remains challenging, but with flexibility, specialisation, and broad positioning, self-employed professionals can still create good opportunities for themselves in the future.