Freelancing – offering one’s skills or services to different clients, usually on a project or contract basis – has grown significantly in popularity over the past decade, with more professionals choosing independent work over traditional employment.

However, this growth has also led to some confusion about what freelancing really means, how it differs from other forms of work, and which definitions apply to which professionals. Freelancer vs contractor? Freelancer vs consultant? Freelancer vs solopreneur?

This article aims to provide clarity by addressing common misconceptions and offering a clearer picture of the freelancing landscape and its flexible workforce.

Join our freelancer community today!

Create your profile in just 2 minutes and start attracting new clients.

Who exactly is a freelancer?

The term “freelancer” dates back to the early 19th century and has its roots in medieval Europe. It originally referred to a “free lance”, a mercenary knight who offered their services to the highest bidder rather than serving a single lord or kingdom. The word “lance” refers to the knight’s weapon, and “free” emphasized that they were not tied to any particular lord.

Over time, the term evolved beyond the battlefield. According to Wikipedia’s definition, a freelancer is someone who is self-employed and is not necessarily committed to a particular employer. They are sometimes represented by a company that resells their services to a client or work independently on a project or task basis, often to multiple clients.

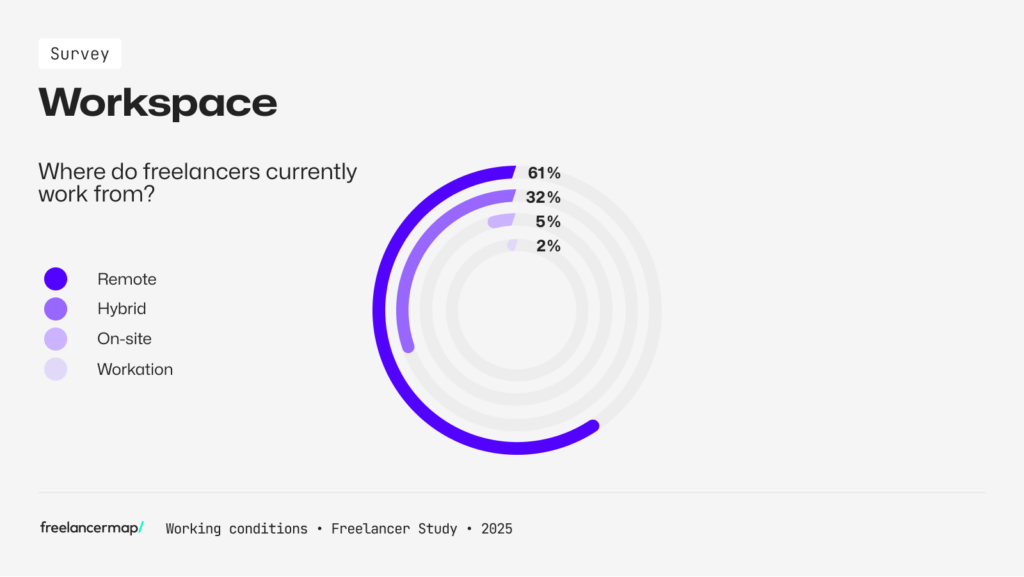

So, freelancers are usually not constricted by contractual agreements such as a non-compete clause, allowing for more flexibility. This opens the door to working on multiple projects at a time. Since a person working for several clients at once cannot be present at all offices, freelancers usually work from home and off-site work is preferred. This is also confirmed by the latest Freelancer Study 2025: 61% of freelancers work remotely, 32% in a hybrid setup, 5% on-site, and 2% do workation.

Freelancers often find themselves working on several one-time jobs or projects as needed.

Typical freelancer occupations include IT and tech roles such as developers, web designers or system administrators and media and advertising roles such as logo designers, Google Ads experts, etc.

The term freelancer is often misused. When discussing a “full-time” employee, the parameters are clear:

- 9 to 5: A standard work schedule

- One company: Dedicated to a single employer

- Manager’s goals: Focused on internal objectives

- Job security: The expectation of continued employment

However, the term “freelancer” conjures a variety of often-misleading images:

- A gig worker designing logos on the weekend

- A tax-savvy contractor doing 40 hours/week under a business name

- A short-term “task-taker” handling leftover work

- A consultant who delivers a report and leaves chaos behind

Deep dive: Freelancer vs employee: Who earns more?

In reality, independent professionals can embody aspects of all these roles, depending on the specific context and their unique professional identity.

What is universally accepted, however, is that people who are referred to as a freelancer, contractor, self-employed or consultant generally do not work as employees or at least not on a permanent employment basis.

Key traits of a freelancer:

- Skilled, independent, project-based

- Works remotely or off-site

- Can juggle multiple clients or assignments

- Not usually bound by exclusivity clauses

- Common in IT, marketing, design, writing, etc.

Clearing the naming fog: Understanding related terms

In the landscape of the independent workforce, some key terms are often used interchangeably with “freelancer”. Let’s define them:

1. Self-employed

The definition of a self-employed worker seems quite simple from its own name: People who work for themselves and not for an employer.

However, the definition of the term self-employment varies across countries and so you need to consider where the person operate the business.

For example, in the U.S, self-employed people have one of the following business types:

- Independent contractor

- Sole proprietor or sole trader (most common business in the U.S)

- Member of a partnership

- Member of a limited liability company

On the contrary, in the UK a self-employed person can’t operate through a limited (or unlimited) liability company.

Key traits of the self-employed:

- Legally registered as independent (e.g., sole proprietors, single-member LLCs/one-person GmbHs)

- May work as freelancers, consultants, gig workers, etc.

- Responsible for their own taxes, insurance, and administration

- May work with one or multiple clients

2. Freelancer vs contractor

Contractors, as the word in itself suggests, work on particular predetermined tasks and are bound by contracts. A big difference from that of freelancers is often in the exclusivity of the relationship with the client.

Freelancers can, like contractors, be hired for a certain task or project. But unlike freelancers, independent contractors are often bound by the contract they have with their client, and are sometimes legally obliged to only work with that particular client until the job is finished, e.g. Website Development projects or ABAP implementation projects.

Such non-compete clauses result in an independent contractor choosing to simply focus on one project at a time, making it more beneficial for them to look for longer running projects. This is also why contractors tend to work directly on-site at the company office instead of at home from a remote location.

Basically, contractors exclusively offer their services, meaning a “stronger” connection to the company. If you are going to have someone work for you on a 2-year-project and that someone is going to work just for you, it makes complete sense to have that person on-site, deeply involved with the project. That way the contractor can exchange ideas, talk to co-workers and get a better general feeling about what he or she is supposed to do and why/how exactly it needs to be done.

Typical independent contractor occupations include: Accountants and auditors, lawyers, bookkeeping clerks, tax consultants, etc.

What’s the difference between contractors and employees?

It might look like a contractor is actually a temporary employee. However, legally there is a huge difference. For an independent contractor, the company is not required to pay taxes and no employment or labor laws apply to them.

Key traits of a contractor:

- Bound by a contract (often longer-term)

- May include exclusivity or non-compete clauses

- Often on-site or integrated into the client’s team

- Clear legal distinction from employees (no payroll taxes or benefits)

- Examples: software developers, engineers, auditors

Contractor vs independent contractor

Contractor is a broader term for someone providing services under contract rather than as a permanent employee. It can include:

Independent contractors (self-employed individuals)

Contract employees supplied through an agency or staffing firm

Companies that provide services under contract (not just individuals)

Example: A construction firm hired by a company to build an office is a contractor.

In short: All independent contractors are contractors, but not all contractors are independent contractors. The exact definitions and legal distinctions may also vary by country.

3. Consultant

The main aspect that makes consultants different from the groups described above, is again to be found within the word itself. Consultants do just that – they consult, meaning they provide a client with an expert opinion, advice or direct training in their field of knowledge, e.g. in the field of SAP.

Generally, a consultant is brought in to a company to help the company grow and learn, or when a project requires a more expert opinion. They are well-experienced in the area they offer their consulting services in and so are generally recruited to deliver plans and solutions quickly, thus saving valuable time for the management team.

Typical consultants occupations include roles such as SAP consultants, IT business consultants, software consultants, data migration consultants, etc.

Key traits of a consultant:

- Offers insight, not just labor

- Hired for expertise rather than execution (though often overlaps)

- May later become a contractor to implement advice

- Typically charges premium rates (project- or value-based pricing)

- Common in IT, strategy, operations, SAP, finance

Consultant vs freelancer

The terms consultant and freelancer are often used interchangeably, even though they describe different roles.

A freelancer is typically hired to deliver specific services or tasks, such as writing, graphic design, or software development. Their focus is on execution, completing clearly defined work for clients, often on a project-by-project basis. Freelancers usually work independently, may handle multiple clients at once, and are paid per hour or per project.

A consultant, on the other hand, is brought in primarily to provide expert advice and strategic guidance. Their role is to analyze, advise, and recommend solutions, often based on years of specialized experience. While some consultants may also assist with implementation, their core value lies in their ability to see the bigger picture and propose effective strategies.

So, what’s the real difference?

Freelancers are hired to do the work, while consultants are hired to define what work should be done and how to approach it. This distinction also affects pricing: consultants usually command higher rates, often charging per project or retainer, as their expertise is considered more strategic and business-critical.

If you want to dive deeper into this topic, head up to the post “Freelancer vs. Consultant: Key Differences, Benefits of the Shift & How to Transition“.

4. Gig worker

The term “gig” originally comes from the music industry, where it referred to a single performance or short-term engagement by a musician. Over time, the meaning broadened to describe any short-term, task-based job, and today it forms the basis of the so-called gig economy.

A gig worker is someone who completes these short-term assignments, often through digital platforms or apps. Unlike traditional employees, gig workers usually have multiple clients or projects at the same time and enjoy significant flexibility in choosing when, where, and how they work. Common examples include ride-sharing drivers, food delivery personnel, or freelancers completing design, writing, or coding tasks online.

While gig work offers autonomy and the opportunity to earn multiple income streams, it also comes with challenges. Gig workers are typically classified as independent contractors, meaning they are responsible for their own taxes, insurance, and retirement contributions, and generally do not receive benefits like paid leave or health coverage. The gig economy has grown rapidly with digital platforms, giving businesses a way to scale labor on demand while offering workers flexible, short-term earning opportunities.

Key traits of a gig worker:

- Micro-jobs or “gigs” (e.g., logo design, ride-sharing, translations)

- High flexibility, low commitment

- Often lacks job security or benefits

- Transactional rather than relationship-based

- Examples: Upwork, Fiverr, Uber, TaskRabbit users

5. Fractional worker

A fractional worker is a professional who provides their expertise to a company on a part-time or fractional basis, typically across multiple organizations. Unlike full-time employees, fractional workers are engaged for a specific portion of their time (for example, a few days per week or month) allowing companies to access specialized skills without committing to a full-time hire.

Fractional work is most common in leadership, management, or highly specialized roles, such as CFOs, CMOs, or IT specialists. This arrangement benefits both parties: companies gain access to top-tier expertise cost-effectively, while fractional workers enjoy flexibility and the ability to work with multiple clients simultaneously.

With the rise of flexible work models and the increasing demand for specialized skills, fractional work has become an attractive alternative to traditional employment, especially for small and medium-sized enterprises seeking strategic guidance.

Key traits of a fractional worker:

- Offers “a fraction” of their time (e.g., 1 day/week)

- Often holds strategic roles like CMO, CFO, CTO

- Greater involvement than freelancers

- Contracts are long-term and role-based

- Usually serves 1-3 clients at a time

6. Interim professional

Interim professionals step into an organization on a temporary basis to fill a leadership or specialist role, often during times of transition – usually several months (longer than a typical freelance project, but shorter than permanent employment).

Interim roles are often linked to management, leadership, or restructuring roles, e.g., interim CFO, interim HR manager, interim project lead.

Like freelancers, interim managers are usually self-employed or contracted through agencies, but their role is more embedded in the company’s structure for the duration of the assignment.

Key traits of an interim professional:

- Steps in for a defined period, often during transitions

- Brings in-depth knowledge to solve specific challenges

- Often takes over senior or managerial roles

- Integrates fast and delivers results from day one

Interim vs. freelancer

Freelancer: Delivers services or project-based work, often remotely, and typically not integrated into company hierarchy.

Interim professional: Temporarily takes on a defined position within a company, often with leadership responsibilities and decision-making authority.

Example:

– A freelance marketing consultant might design a campaign for a company.

– An interim marketing director would step in to lead the entire marketing department until a permanent hire is found.

Interim work is a form of freelancing/independent work, but it’s usually at a higher managerial or specialist level, with deeper integration into the client organization.

7. Solopreneur

A solopreneur is an entrepreneur who runs their business entirely on their own, without hiring employees. Unlike freelancers or contractors who may work primarily for clients, solopreneurs often create, manage, and grow a business around a product, service, or personal brand. They are responsible for every aspect of the business, including strategy, marketing, operations, and finances.

Solopreneurs typically leverage technology and digital tools to scale their work efficiently while keeping the team small, sometimes just themselves. Common examples include online coaches, digital product creators, independent consultants, and boutique business owners.

Being a solopreneur offers full creative and operational control, but it also comes with challenges, such as handling multiple roles simultaneously and managing the uncertainty of income. Like other independent professionals, solopreneurs are usually self-employed, meaning they are responsible for taxes, insurance, and all administrative tasks related to their business.

Key traits of a solopreneur:

- Combines entrepreneurial spirit with hands-on work

- Usually avoids hiring staff

- May provide services like a freelancer, but with a business-first mindset

- Focused on building scalable income (e.g., products, courses, content)

8. Entrepreneur

An entrepreneur is an individual who creates, organizes, and manages a business venture, often taking on financial risk in pursuit of profit and growth. Unlike solopreneurs, entrepreneurs may build a business with the intention of hiring employees, scaling operations, or attracting investors. Their focus is on creating value, solving problems, and developing sustainable business models.

Entrepreneurs can operate in any industry and may start small businesses, tech startups, or innovative ventures. They are responsible for strategic planning, fundraising, marketing, and managing teams. While they may start alone, the ultimate goal is often to grow beyond a single-person operation.

Key traits of an entrepreneur:

- Not limited to service-based work

- May start as a freelancer and grow into a business

- Often hires employees or builds a team

- More associated with startups and innovation

9. External specialist

An external specialist is a professional who provides expert knowledge or skills to a company on a temporary or project basis, without being a permanent employee. Unlike freelancers or contractors who may handle general tasks or deliverables, external specialists are typically brought in for their deep expertise in a specific area, such as IT security, finance, legal compliance, or engineering.

External specialists are often engaged for short-term projects, audits, or strategic initiatives where specialized knowledge is required. They work closely with the company’s internal teams but maintain independent status, managing their own contracts, taxes, and insurance.

This model allows organizations to access high-level expertise without the long-term costs of hiring a full-time employee, while giving specialists the flexibility to work with multiple clients and leverage their expertise across industries.

Examples:

- A cybersecurity expert assessing a company’s IT systems.

- A financial consultant optimizing a company’s accounting processes.

- A legal advisor reviewing contracts for a project.

The difference with a consultant is very subtle: While both are external, independent professionals, consultants lean toward advice and strategy, whereas external specialists provide specialized skills and execution.

Key traits of an external specialist:

- Not full-time staff, but offers critical expertise

- Could be a freelancer, consultant, or contractor

- Usually short- to mid-term engagements

- Term used often in corporate procurement or HR

10. Small business owner (SMB)

When starting out with a freelance job, most freelancers don’t have a bigger business in mind. But freelancing has a way of growing exponentially – especially if you’re great at what you do! A job well done usually results in long-term clients who stick around, while new clients continue to come in. As your client list continues to grow, you may find that the workload is quickly getting out of hand for you to manage alone.

This is when you might want to consider starting a limited company and become a business owner with your small business. Small business owners usually hire people to work with them (maybe hiring a family member?), meaning they have increased responsibility and have to manage their team.

The number of employees one is allowed to have and still remain a small business varies quite a lot depending on the country. You can hire no more than 15 people in Australia, going up to 50 in the EU and reaching a staggering 500 employees in the US.

Once again, a small business usually means more employees and more responsibilities, but can be useful for making a name for yourself.

Key traits of a small business owner:

- May have started as a freelancer

- Now operates a business (e.g., GmbH, LLC)

- Can take on larger projects, manage teams, or sub-contract

- More operational and legally complex than freelancing

The evolving landscape of work is increasingly defined by flexible talent – a broad, modern term encompassing all the terms mentioned above. The emphasis is on agility, scalability, and on-demand availability, making flexible talent a crucial component for enterprises and HR departments in workforce planning.

Importance of the right classification – Understanding false self-employment

In the complex world of work classifications, it’s easy to make mistakes, misclassify roles, and inadvertently create false self-employment – also known as bogus self-employment or misclassification. This occurs when an individual is formally registered as self-employed, a freelancer, or a contractor, but in practice, their working conditions closely resemble those of an employee.

Such misclassification can have significant legal and financial consequences for both the individual and the hiring entity, including issues related to taxes, social security contributions, and labor rights.

Key indicators that might suggest false self-employment include:

- Lack of independence: The individual has little control over their work methods, hours, or location, and is subject to the direct supervision and control of the client.

- Integration into the client’s organization: The individual is treated as an integral part of the client’s team, using their equipment, email, and working alongside employees on an ongoing basis.

- Exclusivity: The individual primarily works for a single client, with little or no opportunity to offer services to other clients.

- Fixed remuneration: Payment is regular and fixed, similar to a salary, rather than project-based or outcome-driven.

- Lack of business risk: The individual does not bear significant financial risk for the work performed and is not responsible for their own business expenses or investments.

Distinguishing between genuine self-employment and false self-employment is vital for legal compliance and ensuring fair working conditions within the evolving landscape of independent work.

Why engage an independent professional?

Engaging independent professionals offers distinct advantages for businesses:

- Independence, experience, and speed: Independent professionals excel when internal teams face bandwidth limitations or lack specific expertise for projects with tight deadlines. Their independent nature allows them to integrate quickly and deliver efficiently.

- Outside perspective: Having worked with dozens of teams, tools, and problems, independent professionals bring a fresh, unbiased perspective. They are unafraid to challenge assumptions, identify inefficiencies, and propose innovative solutions.

- Results-driven: Independent professionals thrive on delivering tangible results. Their compensation and future opportunities are directly tied to the successful and timely completion of projects, fostering a strong commitment to quality and efficiency.

- Ownership of work: An independent professional’s reputation is their most valuable asset. Every project contributes to their professional portfolio, as they are building their own businesses, with clients being integral partners in their growth.

- Strategic thinkers, not just extra hands: The most effective independent professionals are not merely additional labor; they are strategic minds. They co-create solutions, streamline workflows, and accelerate progress towards achieving real business outcomes.

Read more: Working With Freelancers: Hiring, Onboarding and Management

Where to find independent talent?

Flexible talent can be found through a variety of channels, reflecting the increasing demand for agile workforce solutions. Many professionals make themselves available on online talent platforms such as freelancing marketplaces (e.g. freelancermap), gig platforms, and project-based job boards, where companies can quickly connect with skilled individuals across industries.

In addition, specialized agencies and staffing firms act as intermediaries, helping organizations source qualified professionals for short-term assignments or niche expertise. Social networks like LinkedIn have also become popular spaces for businesses to identify and approach flexible talent directly.

This shift underscores a broader trend: instead of relying solely on traditional hiring methods, companies are increasingly turning to on-demand, digital-first solutions to build more dynamic and adaptable teams.

Conclusion

The evolving landscape of work demands a clearer understanding of the various independent professional roles. By distinguishing between terms like freelancer, contractor, consultant, and others, businesses can more effectively leverage the unique strengths each brings. This clarity fosters better collaboration, optimizes resource allocation, and ultimately drives greater success in an increasingly flexible global economy. The independent workforce is not a monolithic entity, but a diverse ecosystem of skilled individuals ready to contribute in myriad ways, provided their roles are understood and valued appropriately integrated strategically.