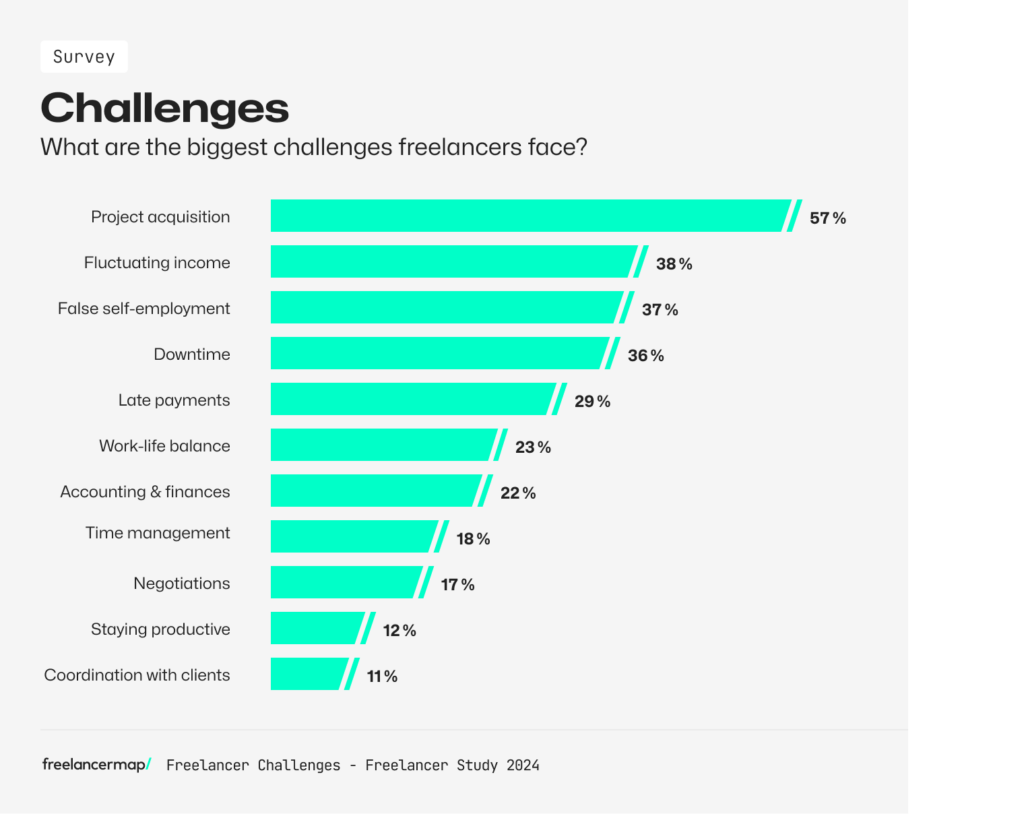

It’s the bane of freelancing existence – getting paid late.

Late payments aren’t just some nuisance freelancers like to complain about – they can be a significant financial risk.

At best, dealing with it wastes valuable time that you can spend either on work or enjoying your life. At worst, late payments mean that you’re unable to pay essential bills like your rent.

In this article, you’ll learn how to deal with late payments and how to send out payment reminders to your clients.

- What is Net 30?

- Disadvantages of Net 30 Payment Terms

- How to prevent or minimize the losses from long payment terms

- How do payment reminders work

- Friendly reminder + Template

- Formal 2nd reminder + Template

- Demand letter template: 3rd payment reminder

If you’re just starting out as a freelancer, you might not be familiar with all the different payment options available to you. For instance, it might seem reasonable to “play by the rules” when your client casually mentions paying in “Net30”.

What is Net 30?

Freshbooks defines “Net30” as “payment being due thirty days after the invoice date.” This essentially means once you invoice your client, they can take up to 30 days to pay you. Other versions of this payment term exist ranging from 30, 60 or 90 days to as short as 7 days.

While this Net 30 term might work for some freelancers, it may not be the best arrangement for you. It’s important to remember that paying by the Net 30 term isn’t a rule – the rules are what both sides agree upon.

So it is up to you and the client to find a reasonable timeframe that works for both of you. If you can’t negotiate that with a client, there are a couple of ways to make long-term payments hurt less.

First, we’ll cover why Net 30 and the likes can be extremely dangerous to freelancers, and then we’ll share a few strategies to minimize or prevent the danger by making use of late payment reminders.

Join our freelancer community today!

Create your profile in just 2 minutes and start attracting new clients.

Disadvantages of the Net 30 payment term

Net30, 60, and 90 all have a couple of major problems. Firstly, this system works on the basis of making freelancers work and provide labor without immediate financial compensation.

Freelancers are not banks that can afford to give out what are essentially loans without interest.

As a freelancer, you are offering up your services as a product. When a Net 30 term is in place, you are essentially selling a product and the client would now like to pay you thirty or sixty days after the work is done. This is, in no way okay. As a freelancer, you are often on a tight budget and this can potentially kill your business.

Moreover, most clients will take Net 30 as an invitation to pay at the latest possible moment. To them, establishing a 30-day timeframe isn’t saying “you have 30 days to pay me”, it’s more like “pay me in exactly 30 days”.

Last but not least, Net 30 and the likes can often be confusing. Are the thirty days over once you deliver the project, once you send an invoice, or, say when the website you built goes live? You can bet accountants will try to take advantage of unclear terms and extend the long-term payment even further.

For these reasons, we encourage freelancers to avoid NET 30 agreements.

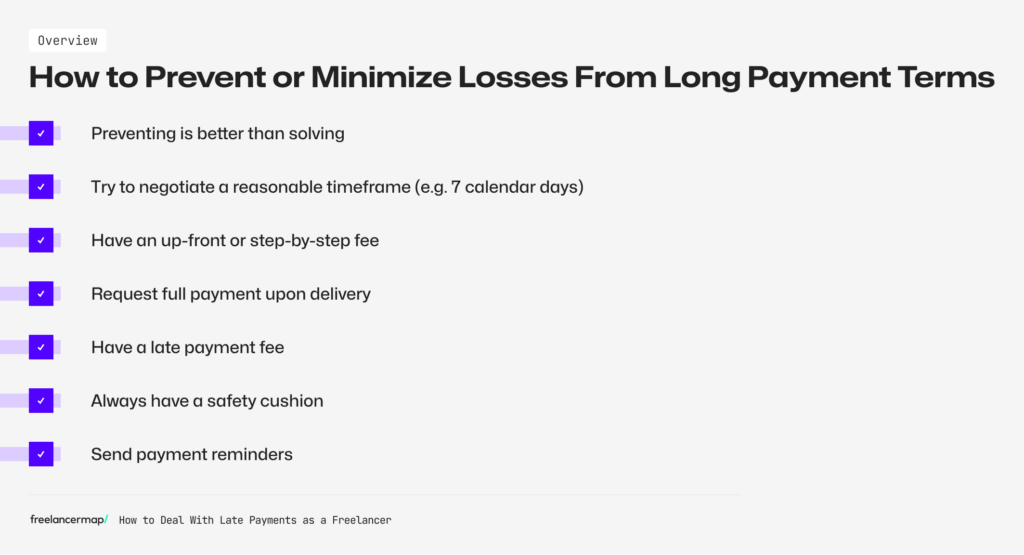

How to prevent or minimize the losses from long payment terms

1) Preventing is better than solving

Preventing a problem is oftentimes better than trying to solve it once it has already occurred. This is also true when dealing with late payments. The best way to do this is by setting up a good contract.

Getting money upfront, once you have completed your work or having milestones across the project if it’s longer, are all sensible decisions. It might take some work to see which works best for you and to convince your clients, but it’s well worth it.

Secondly, make sure that you don’t shoot yourself in the foot. A common mistake with freelance writers is to have a clause that says you get paid when your work is published. But imagine you submitted an article six months ago and the client is just now including it in their newsletter – that’s neither your fault nor is it your job to place your content. Be wary of those tricks.

2) Try to negotiate a reasonable timeframe (e.g. 7 calendar days)

Explain to your client why a timeframe of one month doesn’t work for you and what your concerns might be. Believe it or not, there are times when clients just include the 30 days in the contract because that’s how they’ve always done business with other companies. But you can often convince them to change that. Seven days are a reasonable time you can aim for.

3) Have an up-front or step-by-step fee

One of the ways to minimize the losses of long-term payments is to split up the amount of money your client has to pay you. There are generally two ways to do this.

The first one is establishing a lump sum up-front – as soon as you start working on the project you get 20 to 50 percent of the payment immediately.

Depending on whether or not the client trusts you, that can be a good way to handle the situation.

Another strategy a lot of freelancers love is splitting up the project in different steps (aka milestones).

Let’s say you’re writing a ten-page tutorial for a software product. The first step might be the general structure and a few sentences for each chapter. The second could be the initial draft, the third the finished product.

If you make sure to get a third of your payment for each step, long-term payments will be easier to manage.

4) Request full payment upon delivery

To avoid any confusion about when you’re getting paid, you should always establish what “finishing the project” actually means. As a rule of thumb, always go for full payment upon delivery. Going back to the example of building a website, you’re done as soon as your part of the job is ready.

If the client wants to engage writers to fill it with content or do an internal test run for a couple of weeks, they’re free to do it. But you’ve done your job and are entitled to your money.

5) Have a late payment fee

If nothing else helps, late fees can be a good incentive for a client to pay on time. You might want to give people the benefit of the doubt by establishing some wiggle room. In your contract, that might look something like this:

“Should the payment not be received in three days after the initially established date, a late fee of X is due.”

6) Always have a safety cushion

Sometimes, clients won’t budge, regardless of late payment fees or any other precautions you might have set in place. In that case, you have to ask yourself the following question:

“What is this client worth to me?”

If this is a client you’ve had a long business relationship with or the project is especially lucrative, you might want to swallow it down and still take the terms.

But if that’s not the case, don’t be afraid to say no (here is how to turn down freelance work the right way) – that’s a lesson many freelancers have had to learn the hard way.

7) Send payment reminders

Sometimes, clients won’t budge, regardless of late payment fees or any other precautions you might have set in place. In that case, it’s time for you to follow up with payment reminders to your client until you receive your payment.

How do payment reminders work?

Payment reminders are the creditor’s specific and explicit requests to his debtor to provide the service owed (in our example, payment for services provided by the freelancer).

There are no special legal requirements or particular formats for payment reminders. So, the reminder can be made in writing (via letter, fax or email), and/or verbally (via phone call or stopping by the client’s office).

Generally, entrepreneurs think that they have to admonish the debtor three times before they can take legal action. However, after the first reminder, the debtor is already in default. That means they have to take over all other costs that the prosecutor incurs by chasing the late payment.

After the first reminder (which is often called “the friendly reminder”) is sent, the debtor will expect that there will be more payment reminders before they actually have to pay. As we said, this is also what entrepreneurs generally think.

Would you like to automate payment reminders?

Bonsai makes it possible – with automatic late payment fees, too!

> Explore Bonsai invoicing (7-day free trial)

How does this work in the sphere of freelancing?

You have completed your order on time and in a professional manner and have invoiced the customer accordingly. But the customer does not pay by the due date. This isn’t something about which you can be blasé or that can be ignored.

So here are a few free templates for payment reminders to chase that late payment.

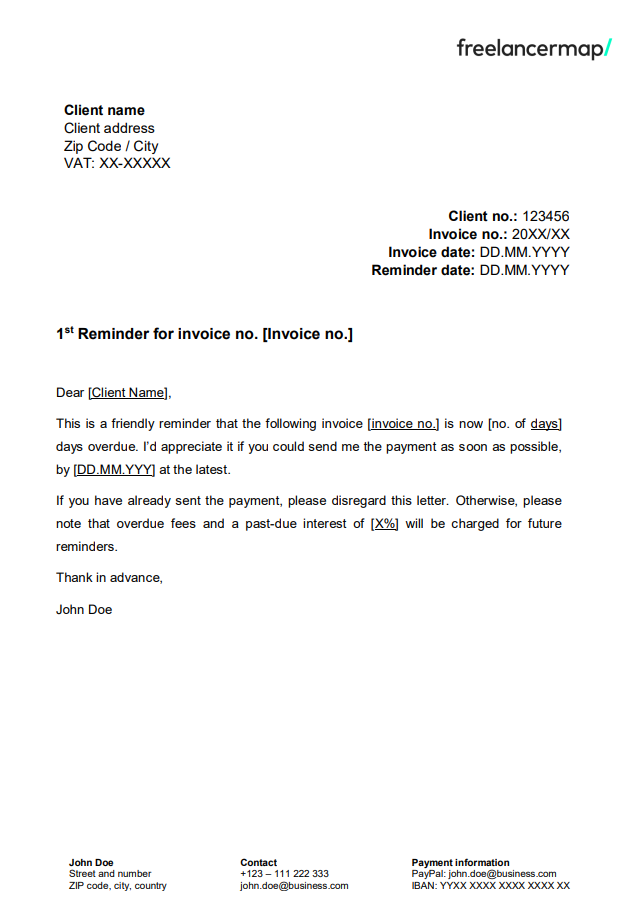

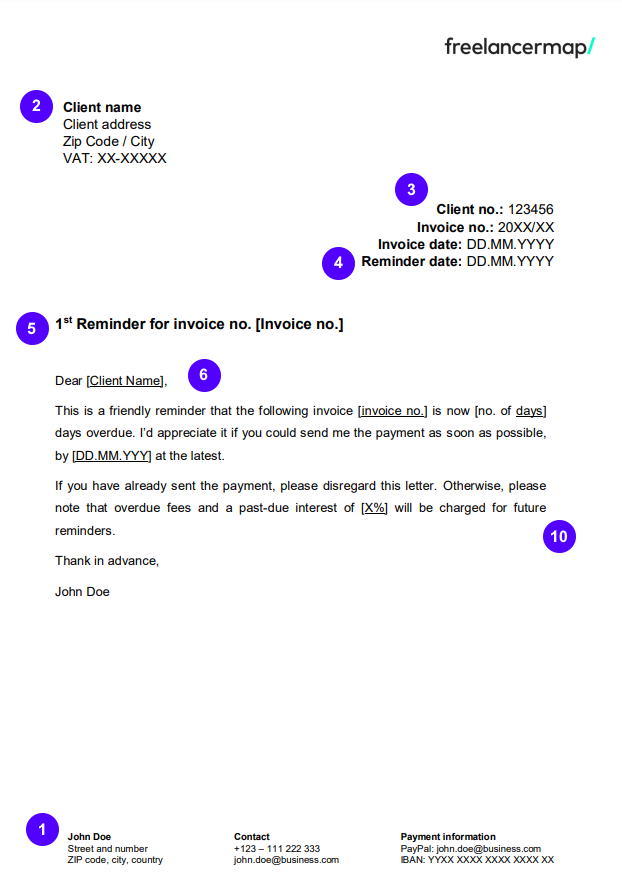

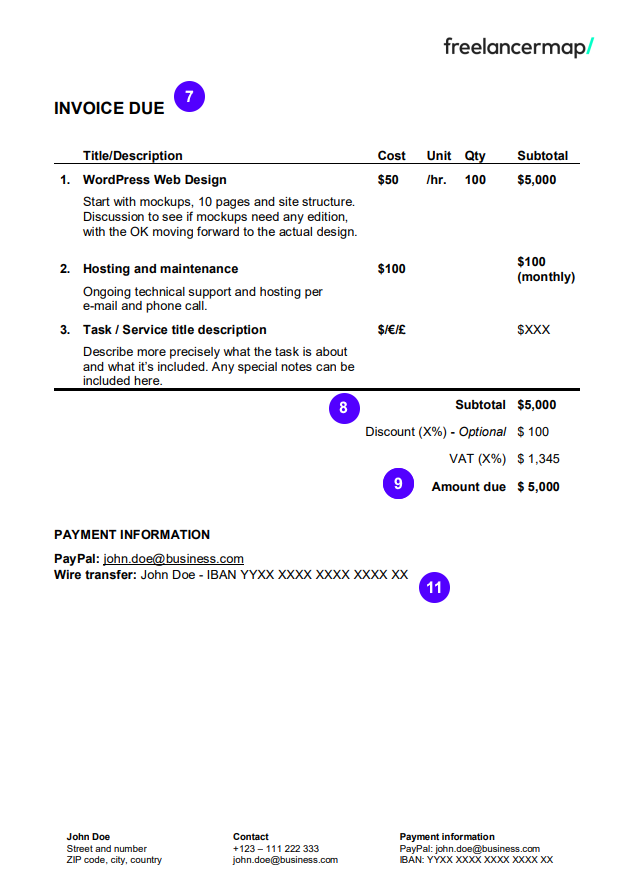

Payment reminder letter sample: Friendly request

1st Payment reminder Template in Word, PDF or PPT

Now we get into the timeline of chasing after money that should have already been sent to you. The beginning of that should be nice and simple. Just send an email or contact the client like you usually do. Ask them if they got your invoice, whether or not they liked the product and when you should be expecting your money.

If the client doesn’t pay you by the due date, it’s time for you to send them a “first reminder” or “friendly reminder”. The exact time that you contact the client is up to you; it can be a day after the due date or a week after the payment was due.

As a rule, first payment reminders are written in a polite and friendly manner. A deadline is not necessary, nor the threat of certain legal consequences. It is enough if the creditor (freelancer) clearly states that he or she now expects the payment from the customer as soon as possible. You will be able to think of consequences later if the client still ignores your request.

What you should include in the first reminder:

- Creator Name and address – that’s you

- Client Name and address

- The client’s number , invoice number and invoice date

- The date when the letter/email/message is sent

- Clear mention that this is the first payment reminder (use bold format, etc.)

- New payment due date of 5 to 10 days

- Description of services provided

- Taxes/discount – if applicable

- The overdue amount

- Summary of further actions in the dunning process

- Payment details from the freelancer (how the client should pay)

Extra tips on sending your 1st friendly reminder

TIP: In order to give your customer the opportunity to comply with the deadline, this reminder should expire on a working day. The intent of this first reminder is to get paid so try and give your client the chance to see your email or letter.

TIP 2: Do not forget to keep it natural and friendly as you still don’t know what the reason for the late payment is. Invoices go past due for many reasons other than an unwillingness to pay, so don’t take it personally (for now).

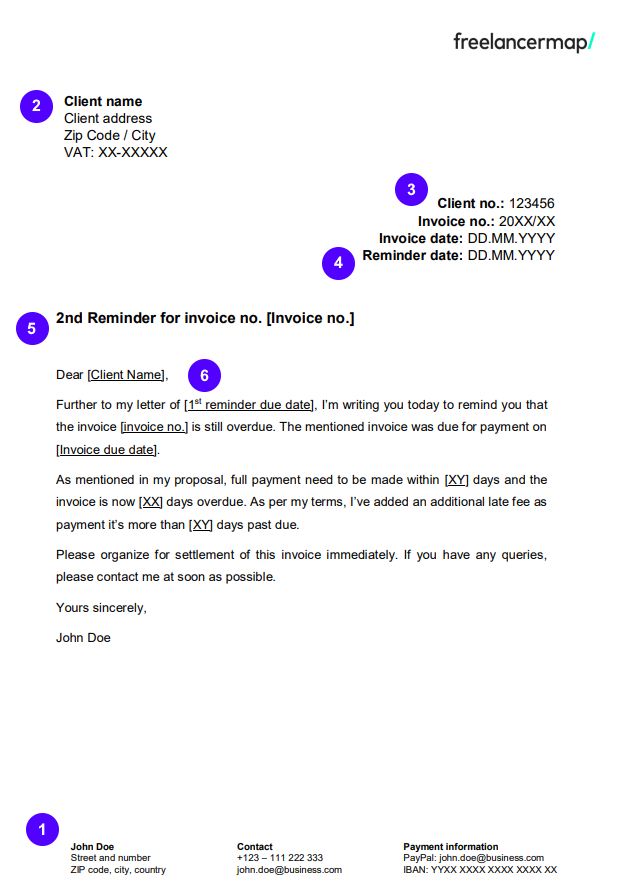

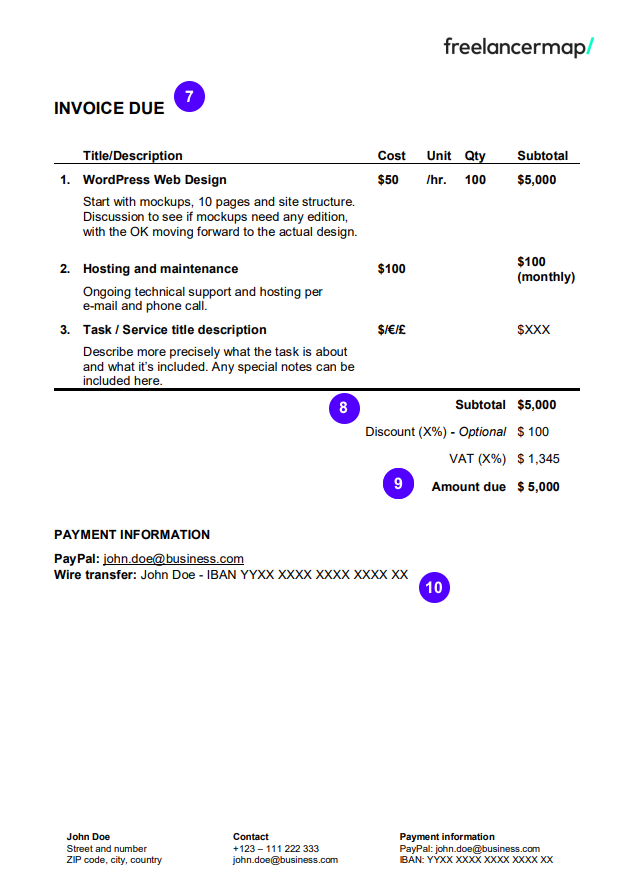

Payment reminder letter sample: Formal 2nd reminder

2nd Payment reminder Template in Word, PDF or PPT

If the first reminder period has expired and you still haven’t been paid, send a second payment reminder to your client.

The format for a second reminder is similar to the first one. It includes information regarding the project, the client, you and payment details.

The time interval between the 1st and 2nd payment reminder depends on whether a payment deadline has already been set in the 1st reminder. If you have not set a payment deadline in the first reminder, it is normal to wait about 10 days before sending a second reminder, but of course this timeframe is just a suggestion and you decide what works best for you.

Remember, make sure that the deadline is during the typical work week.

As the client was already notified that there is an amount overdue, the client is obligated to pay not only the principal invoice amount but also additional fees that might arise (interest and late fees).

Hint: Our recommendation would be to include a late fee up to the second reminder. The late fee amount should rise according to the steps taken in chasing the payment. It can be as little as five dollars or a percentage of the amount due.

Alternatively, you can call them up and inform them that you’re still waiting to get paid for the work you did. Some people need to be reminded twice, especially when it comes to money.

What you should include in the second reminder:

- Creator Name and address – that’s you

- Client Name and address

- Client number, invoice number and invoice date

- Date the letter/email/message is being sent

- Clear mention that this is the first payment reminder (use bold format, etc.)

- New payment due date of 5 to 10 days

- Description of services provided

- Late fees and summary of further actions in the dunning process

- The overdue amount

- Payment details from the freelancer (how the client should pay)

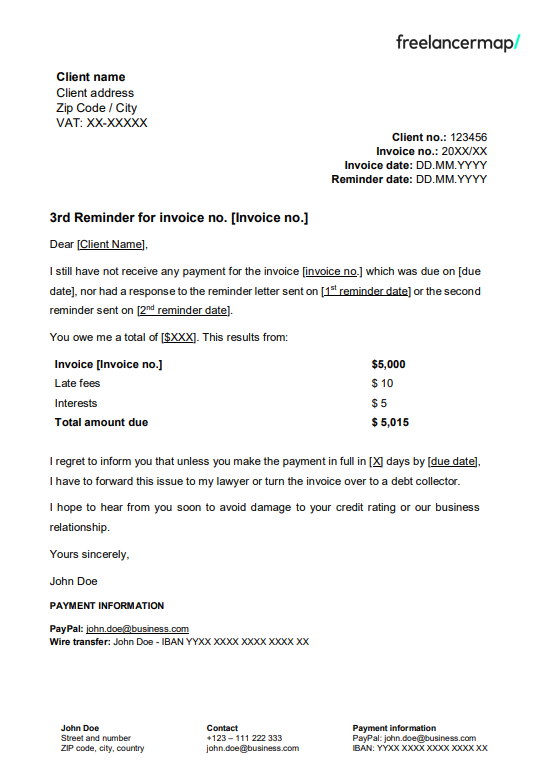

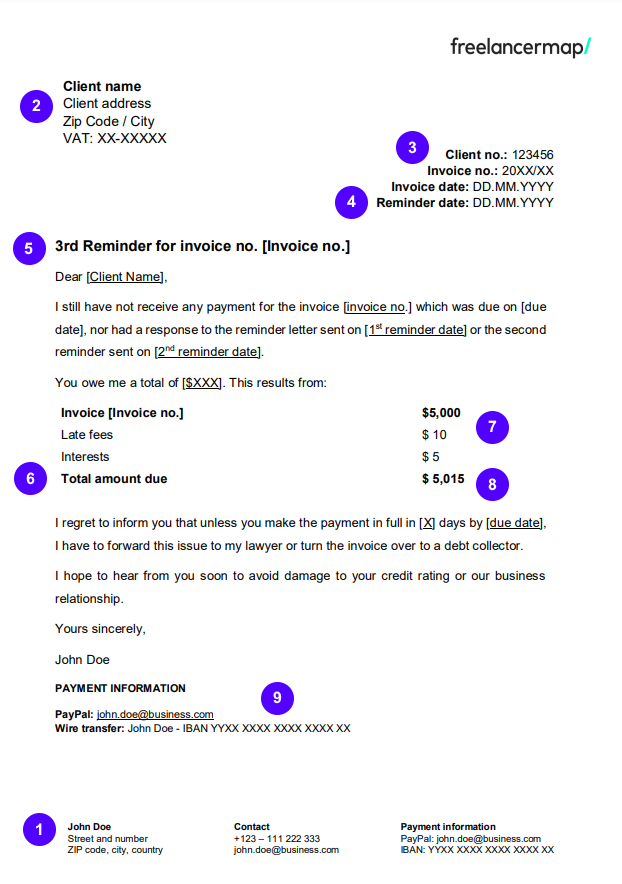

Demand letter template – 3rd payment reminder

3rd Payment reminder Template in Word, PDF or PPT

If the payment is still overdue and your client hasn’t responded to the second reminder, it’s time to send them a third payment reminder. The third reminder is sometimes called the “last reminder”/“demand letter” for payment.

This last letter is sent after the deadline set in the second reminder passes. If you didn’t set a deadline in the second reminder, you could consider an interval of about 15 days.

In the third payment reminder, one will unequivocally set a final deadline for payment and inform the client that further legal action will be taken in case of no payment. This will make it clear to the client that this is a serious business issue and that it’s not okay to ignore your previous reminders.

Bill the customer separately for the interest incurred and late fees. The third reminder period should be the shortest (we suggest a 5-day deadline).

TIP: Things are getting serious and now is the time to escalate the issue. If your regular contact at the company isn’t willing or able to pay you, call their superiors or the accounting department.

Information to include in the 3rd Payment reminder

- Name and address of the creator – that’s you

- Name and address of the client

- Client number, invoice number and invoice date

- Date the letter/email/message is being sent

- Clear mention that this is the 3rd (and last!) payment reminder (use bold format, etc.)

- New final payment due date

- Late fees and summary of further actions in the dunning process

- The overdue amount

- Payment details from the freelancer (how the client should pay)

Additional tips on sending your 3rd payment reminder – Last Resort

At this point, you may be struggling to pay your bills or are simply angry that you needed to go this far to get paid. Although the friendly tone from the 1st reminder will be gone, you need to keep it professional. You now need to show the client that they have one last chance to pay up.

Often, if you get a debt collector or a lawyer involved, the client will finally send the payment.

After this point, if there is no response, legal action must be taken. Do not allow clients, no matter how big or important, to walk over you and delay the payment you deserve.

Option A: Public shaming

Option A is to bring up the issue in public – nowadays that means Facebook or Twitter. Sending out a message that the whole world (including other freelancers) can see, is damaging to a company. Many will try to alleviate the issue as soon as possible to avoid bad reputation.

Option B: Lawyering up

When even shaming your client isn’t enough and the sum you are owed is significant (think upwards of 5,000 US dollars), getting a lawyer might be a bittersweet option, but it might also be the only one you have left. Be sure to consider how much time and money lawyering up will amount to, because it might just not be worth it. But if it is, go for it – you had a contract where you held up your end – the client should hold up theirs.

Use these templates and tips for payment reminders to get your point across in a way that is both assertive and professional! Get paid!

For more templates: • Proposals • Order confirmation • Invoice