As someone running their own business, insurance is definitely something you should consider. Whether you want to protect your equipment, your work itself, or against any potential injuries, there are tons of freelance and self-employed insurance options out there. However, what do they all mean, and do you actually need them?

To help you answer these questions, we’ve put together a list featuring several different types of freelance insurance options and what each of them entails.

- Do I need insurance as a freelancer?

- Why do clients ask you to have insurance to work with them?

- Insurances for freelancers and self-employed

- Common claims among freelancers

- What insurance do I need? Recommendations

First things first though, do you actually need insurance?

Do I need insurance as a freelancer?

Consider this – you’ve taken on a big-time project worth tens of thousands of dollars. You’re all set to finish up soon but you’re faced with sudden equipment failure which leads to a failed project. The unhappy client then decides to sue you for the entire cost! Now what?

There will likely be a legal case, even though it wasn’t your fault. And you’ll have to pay tens– or hundreds– of thousands of dollars in fees and damages. This is where having insurance comes in handy.

When it comes down to it, insurance is something that you need to consider depending on where your freelance business currently stands. Smaller-scale freelancers that do not actually deal with big-time projects cannot really justify the cost of insurance.

But if you’re a freelancer who works on big projects, having insurance might just be in your best interests. Also, clients will sometimes ask you to have insurance if you want to work with them.

Are they anticipating that the project will fail by including a clause in the contract asking you to indemnify them for any loss, liability, damages or expenses arising from any breach of the agreement?

Not really. However, as a company, they have their reasons when they ask you to be insured before starting working.

Why do clients ask you to have freelance insurance to work with them?

Because working with an insured professional is way safer for them.

Hiring a freelancer can be risky for companies, as the responsibility for the job lies heavily on the freelancer and any mistake or misunderstanding can result in the company suffering financial losses.

Fortunately, if the professional is insured, damages can be recovered – for example, if the freelancer fails to meet the standards or is late in their deliverables.

It’s essential to have insurance, but make sure you use it prudently and only as a means of protection in the event that someone takes legal action against you.

When discussing the insurance clause with your client, ensure they are aware of the extra fees associated with a higher level of coverage. Some clients might have standard clauses asking for a high level of coverage – e.g. $10,000,000 professional and public indemnity insurance – that is an unnecessary level of coverage for the majority of freelancers.

Propose a lower level of coverage (something around $1,000,000 and $2,000,000 should be sufficient) and explain why you believe this is a sufficient level – if necessary, you can explore the option of raising the coverage for certain projects or situations.

Remember, the less insurance coverage you take out, the less the cost for you.

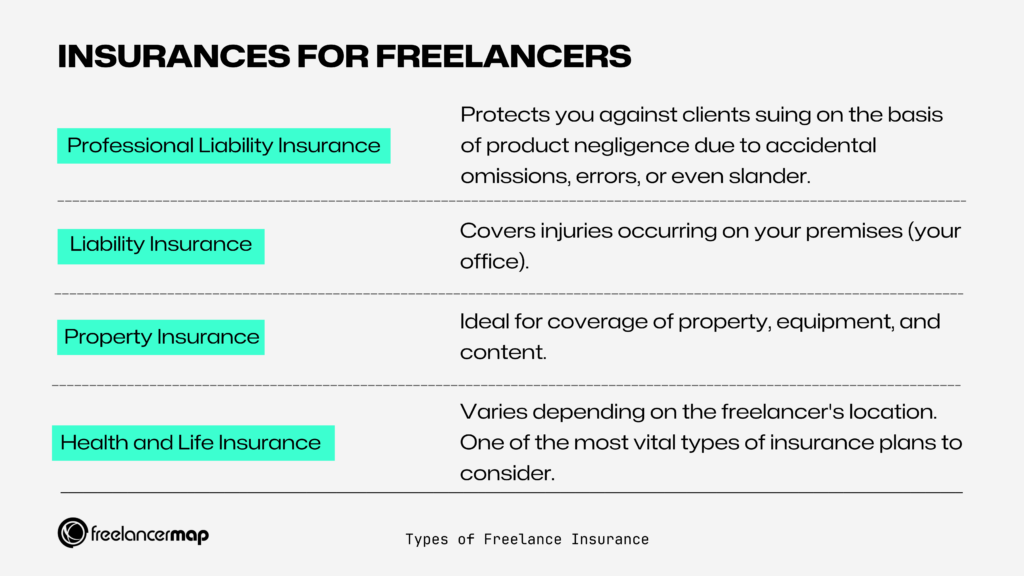

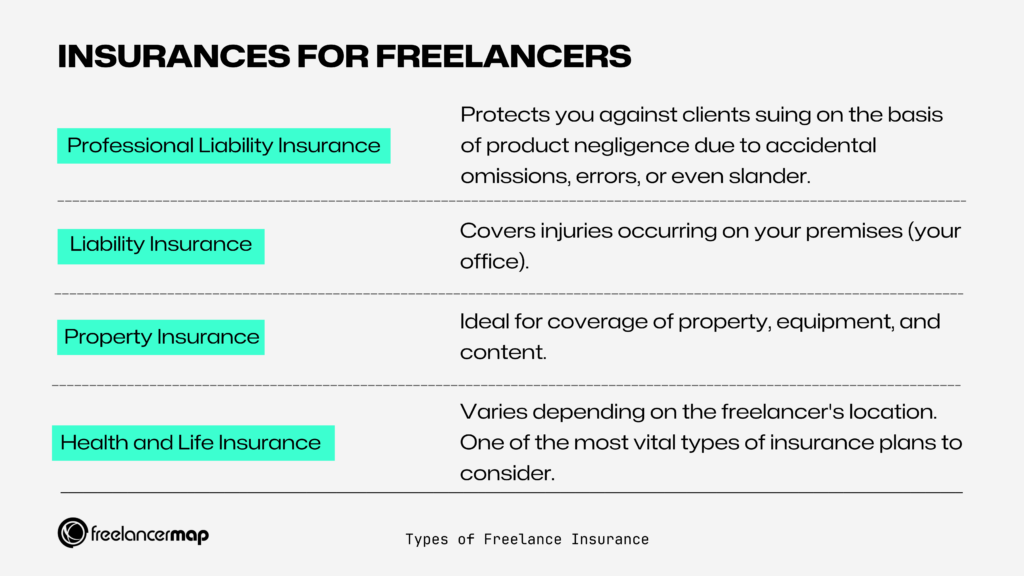

What insurance do freelancers and self-employed need?

Apart from public liability insurance, you also have to consider plans for health and home insurance or professional indemnity insurance.

1. Professional liability insurance

Professional Liability Insurance or Professional Indemnity Insurance or otherwise also called Errors and Omissions (E&O) Insurance is one of the most common types of insurance used by freelance professionals.

It protects you against clients suing on the basis of product negligence due to an accidental omission, an error or even slander. Some big businesses actually require that you have this type of insurance before agreeing to work with you.

Keep in mind though that for freelancers with small or medium sized businesses, this type of insurance is not really necessary since it does seem to cost a bit. As your business starts to grow though, you should definitely consider getting the freelance Professional Indemnity Insurance for yourself.

Please note that if you have employees working for you in your freelance business, they also need to be included in the professional liability insurance!

2. General liability insurance

The second type of freelance liability insurance we’re looking at covers injuries occurring on your premises (your office) or if someone is injured because of your business (you bring work on the client’s office).

But do freelancers really need liability insurance? If a client comes over and gets bitten by your dog, falls on the toilet floor, or something similar to that, liability insurance will generally cover it.

Just like professional liability insurance, some clients may require you to have public liability insurance before agreeing to work with you.

However, if you work from your home and don’t usually invite clients over, the risk of injuring someone at your work premises is probably not high enough to justify the expense.

3. Home and Contents insurance

In case you are working from a home office, you might want to look into home insurance and check whether they cover your office and equipment. Sometimes they do, but sometimes they don’t.

Most of the time they cover anything, apart from more professional items like photography equipment. If the latter is the case, a contents insurance might be a good way to protect your property.

If your work equipment will cost a rather hefty sum to replace in case of a fire or a robbery, this type of insurance will cover it. It really depends on the tech you have – a 1,000 dollar laptop alone probably doesn’t justify contents insurance.

4. Health insurance

These types of insurance are probably more familiar to you. As a freelancer or self-employed, your health insurance will not be as affordable as that of regular employees. The exact amount, however, depends on each individual.

In any case, you might want to consider joining a group for health insurance, like the Freelancer Union (US) or The Editorial Freelancers Organization, for example. Joining such a “guild” will help you get health insurance at a price you can afford.

Freelancers in the US have a couple of options when it comes to health insurance:

- Affordable Care Act – ACA or Obamacare is a great option for freelancers looking for affordable health insurance. Keep in mind though, the recent changes in ACA policy no longer makes it a requirement. This could affect pricing and premiums in the long run.

- Cobra Coverage – If you’re just starting out and are looking to become a freelancer, check with your insurance provider first as most insurance plans offer the option to convert your existing group plan into an individual plan.

- The Freelancers Union – The Freelancers Union offers a health insurance plan for freelancers. Head over to their website to learn more about choosing the right plan tailored to your needs.

- Spouse Insurance Plan – If your spouse works and has coverage through their employer, this may be a good option. Because it’s an employer-based plan, it may also save you money, because it may charge a lower premium for dependents.

Freelancers in Germany have two different kinds of health insurance available: public (statutory) and private.

If you are a freelancer staying temporarily in Germany, we would recommend you get yourself private health insurance as getting into the public insurance group is not generally easy for freelancers and the self-employed.

Health insurance for freelancers: Remote Health by SafetyWing

On the other hand, if you’re looking for health insurance that works regardless of where you live, work or travel, you should check SafetyWing Remote Health.

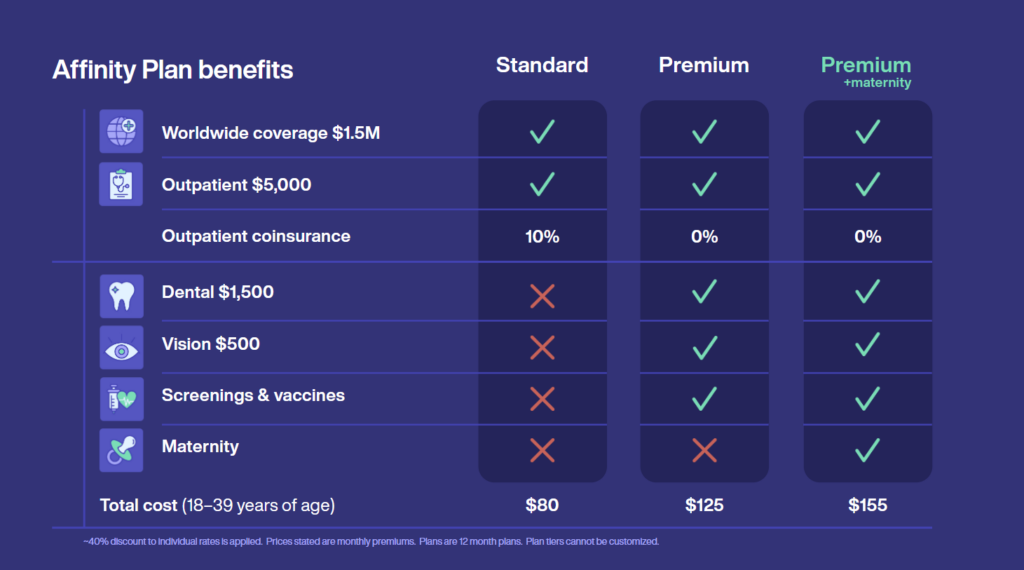

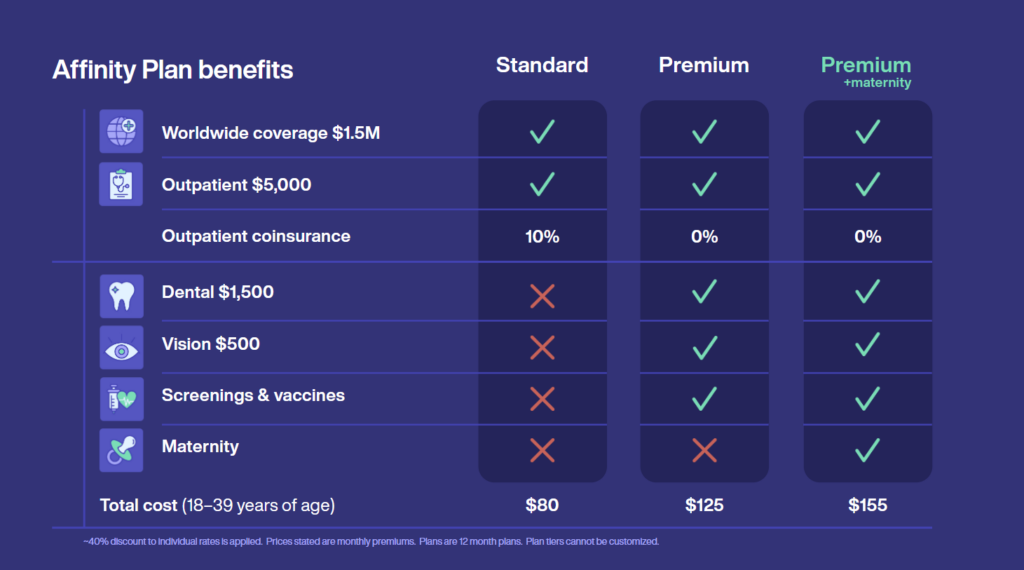

freelancermap has partnered up with them to bring their product at a discounted price to all our freelancers. With Remote Health, the freelancermap community can:

- Access the best healthcare in 175+ countries

- See any doctor at any clinic or hospital, private or public

- Lightning-fast support from real humans, 24/7 from anywhere

- Premium benefits like dental, vision & maternity with high coverage limits

- Coverage for your pre-existing condition, as long as you sign up through freelancermap

- No waiting periods, so you can access all your benefits as soon as your contract begins

- Coverage in your home country

Log in to your freelancermap account to see the different plans available (standard, premium, premium + maternity) and get your discount as a freelancermap user:

Just looking for travel insurance? Explore SafetyWing’s Travel medical insurance

Get medical and travel insurance if you are in an accident or fall sick outside your home country. It includes coverage for lost luggage, travel delays, or natural disasters.

It can be purchased while already abroad, covers home trip visits and operates like a monthly subscription.

5. Life insurance

Your life is valuable and if the worst is to happen, you would want your family and relatives to have some financial security after your passing.

Keep in mind though that the types of life insurance available to you depend entirely on the country you live in.

6. Cyber insurance

Cyber insurance, also called cyber liability insurance, is an insurance policy that can help protect your business against any losses that might occur from cyber attacks and cyber crimes.

Because cyber attacks are becoming more common and sophisticated these days, you should consider getting cyber insurance for your business. All it takes is one hack to jeopardise your company data or even worse, that of your customers.

Depending on the insurance provider you choose, the exact losses that are covered can differ though generally, cyber insurance can cover:

- Data breaches involving sensitive information

- Business interruption losses

- Cyber security and privacy liability

- Crisis management

- Media liability

Most common claims by freelancers

#1 Mistakes in work due to typos or wrong design

This is a common claim among designers. For instance, if a type error on a product’s packaging is discovered after the final product has already been printed, the client may require the designer to cover the reprinting expenses (because the freelancer was responsible for the packaging).

Yeah. Mistakes happen. However, to avoid such a situation, your contract agreement should contain a clause requiring that the client sign off on all stages of the work, thus holding them accountable if an error is found after printing.

#2 Technical issues

This type of claim is more often an issue for developers and software engineers.

Let’s say a developer causes a technical error in the client’s app code that makes the app not work properly for some hours so that end clients can not buy from them.

The client could hold the developer responsible for any lost revenue due to a technical error they caused in the application code and seek compensation for the estimated cost of the money lost related to the malfunctioning app.

Technical bugs can be expensive but are also inevitable. Such situations can also be avoided without insurance by including a clause that mentions that bugs are inevitable and specifies your responsibility in terms of bug fixing.

#3 Management issues

Project managers and tech leads often face this type of claim. They encounter disputes when the project scope shifts unexpectedly and deadlines are missed.

These disputes can involve the client claiming that the work they have paid for is not what they received and demanding extra costs to be covered for hiring other freelancers in an attempt to speed up the process.

To ensure that timelines and expectations are met, it is essential to clearly define the scope of the project and its associated delivery dates in the initial contract. If the client requests any changes to the scope of the project during the course of it, they must know that such changes are not included in the contract and would require additional payment. Setting clear expectations from the outset will help to ensure that any unexpected delays are minimized and insurance is not needed.

#4 Dissatisfaction

Often an issue amongst creative professionals. The freelancer delivers the work – e.g. a landing page – and the client does not like the design, so they ask you to pay for the cost of hiring a new freelance designer.

Client expectations are sometimes difficult to meet, that’s why it’s important to discuss the work process and define the briefing upfront.

So, what insurance do I need to cover my freelance business?

Generally, insurance can be pretty helpful, but you should always try to evaluate the risk factors involved. If it is extremely unlikely that some of the situations described above will occur, your hard-earned money might be better spent elsewhere.

If you can afford them, however, and you often work with high-profile clients, some of the insurance types might be a necessity.

For example, it is essential for freelancers in Europe, particularly Germany or Belgium, to have liability insurance when working on a major project with a company. That is a requirement for many companies when hiring a freelancer.

Having an insurer helps freelancers navigate stressful situations in case they happen. The insurer will negotiate what the freelancer’s client and cover the cost of compensation if needed.

Also, remember that some insurances come in a bundle with significant discounts. Just make sure you consult with legal counsel before jumping into any financial agreements!

You might also like:

- Should Freelancers Sign Non-Compete Clauses?

- Intellectual Property Rights for Freelancers

- NDA for Freelancers: Non-Disclosure Agreements Explained

*Please note that this blog post should not be considered as a substitute for legal or financial advice. Each financial situation is different. The advice provided above is intended to be general and each freelancer should consider their particular financial situation before making any decisions.