Freelancing in Germany is an attractive prospect for many professionals. The country is well known for having one of the strongest economies in the world and the IT talent shortage is making companies even more open to hiring freelancers. If you’re considering freelancing in Germany (whether you are already living in Germany or have not yet moved!), this article is for you!

- Working as a freelancer in Germany

- How do I become a freelancer in Germany?

- Freelancing + Early retirement [2023 update]

- FAQs related to freelancing in Germany

- Common German terms + English translation

Working as a freelancer in Germany

The freelance market in Germany is strong. After all, one cannot forget that Germany was one of the first countries in Europe to adopt freelancing. Data from Eurostat states that in 2021 there were 1.1 million freelancers in Germany.

freelancermap has been playing a key role in the freelancing scene in Germany since 2005 and we do all we have in our hands to support and help freelancers thrive – especially those working in the tech and digital scene.

For the last 7 years, we have published a report intended to gather insights from IT freelancers that can help the community understand the market and grow their businesses. Year after year, the results prove that becoming a freelancer in Germany is an attractive option.

Here’re some freelance statistics from Germany gathered in the 2022 Freelancer Kompass:

- Freelancers in Germany charge €95/hour on average

- SAP freelancers are one of the best-paid freelancers with an average hourly rate of €116

- Freelancers in Hamburg and Saarland have the highest rates (average: €102) while freelancers in Bremen have the lowest (average: €67)

- IT freelancers in Germany get a net income of €6,178

- 72% of freelancers are satisfied with their income

- 69% of freelancers work from home

- Only 17% of freelancers are now working exclusively at the client offices (51% of freelancers worked at the client’s offices in 2021!)

- The gender pay gap for IT freelancers in Germany is €9 (Men €97 vs women €88)

- 63% of freelancers say that they earn more than their counterparts working full-time

- 90% of freelancers consider expertise and know-how as the key to succeed

- Benefits mentioned: Independence (73%), freedom to decide (64%), time management (57%) and project diversity (51%)

Figuring out your own rates as a freelancer in Germany is not easy but with our formula and guide you’ll get it right:

> How to set your freelance rates 💰

So now, you might be asking yourself: Do I really need to register as a freelancer in Germany?

The answer is YES.

If you’d like to provide your services in Germany, you’ll need to register as a freelancer to make sure you meet your legal and tax obligations.

How do I become a freelancer in Germany?

Besides its great healthcare system, Germany is also known for its bureaucracy. And so, freelancing in Germany might seem a bit challenging at first.

You’ll have things like taxes, health insurance, required documentation, etc. to consider but before you worry about all of this, you’ll need to understand the options you have to start your own business.

There are different concepts around the term freelancing in Germany: Freiberufler, freier Mitarbeiter, Freelancer, or Gewerbe.

It’s important to understand these to know which legal form you’ll need. So let’s take a look at the options.

Professionals who want to go freelancing in Germany can choose between two forms of sole proprietorship: non-commercial and commercial. In both cases, the founder must be a natural person.

#1 Commercial: Gewerbliches Einzelunternehmen

If you work as a tradesperson and run a commercial business that sells products, your work is classified under the trade self-employment ‘Gewerbe’. To begin, you must first register with the German trade register or ‘Handelsregister’ and then contact the trade office to apply for a trade licence.

You will then need to pay trade tax ‘Gewerbesteuer‘. The trade tax varies depending on the city you’re in and is calculated by multiplying 3.5% of your profits with the local tax factor ‘Hebesatz’.

You can register as a “Kleingewerbetreibender” to not pay the trade tax (“Gewerbesteuer”)

#2 Non-commercial: Freier Mitarbeiter (Freelancer)

A freelancer or ‘Freier Mitarbeiter’ is a person who is hired by companies for short-term projects or tasks. These professionals are not direct employees of the company but work on a contract basis (Werkvertrag).

Is a Freiberufler a Freelancer?

The term “Freiberufler” identifies professionals as members of a certain professional occupation (§ 18 para. 1 EStG), but it’s not a legal form.

“Freie Berufe” includes professionals with medical, pedagogical, consulting or technical occupations. Technical professions such as software developers, or IT consultants are becoming increasingly popular.

💡 If you are unsure about your case, we recommend you check your case at the tax office (“Finanzamt”) or the trade offices (“Gewerbeamt”). You could also consult a lawyer or tax advisor before registration.

#1 Freelancing in Germany: Registration (Freiberufler anmeldung)

The process of registering and becoming a freelancer in Germany is going to be easier or more complicated depending on your passport (aka. nationality).

If you are in Germany (and a EU, EAA, or Swiss citizen) the process will be easier for you as you can work without a visa in the German labour market.

To register as a freelancer, you will need to submit a form to the German Tax office (“Finanzamt”) called Fragebogen zur steuerliche Erfassung.

You can do this online via ELSTER, but please note that it’s all in German and you’ll need to create an account first. It’ll take a couple of days to get this set up as the tax office will send you activation data by post.

Once you’re officially registered as a freelancer, you’ll get your Steuernummer or Ust. Nr. (Tax ID) and so you will be ready to start invoicing clients.

The Finanzamt will also explain your tax obligations as a freelancer and let you know when you should submit your VAT declarations.

🌎 You can request your VAT ID number (Ust Nummer) as well if you plan to bill VAT in your invoices, for example, if you are going to work with clients in other EU countries (Reverse charge).

If you’re not in one of the countries mentioned above and would like to become self-employed in Germany, you have options, too.

#2 Visa

If you come from a different country, you will be required to apply for a visa to get employed. Germany offers a visa for self-employment that is different if you are planning on setting up a business or working as a freelancer.

If you’re freelancing in Germany, you’ll need to specifically apply for the Freelance Visa (According to Section 21 (5) AufenthG). This Visa is typically valid for 3 months and can be converted into a residence permit ‘Aufenthaltserlaubnis zur freiberuflichen oder selbständigen Tätigkeit’ once you’re in the country.

These residence permits are valid for up to 3 years. If needed, the permit can be extended.

The requirements for the German self-employed visa are:

- Your freelance occupation is recognized as a self-employed professional occupation in accordance to s. 18 Income Tax Act. Freelance occupations include artists, writers, doctors, auditors, architects, or IT professionals such as engineers.

- You have enough funds to finance your project (Revenue forecast)

- Having all the paperwork and professional licences required to perform the job

- If you are over 45 years old, you’ll need an adequate pension plan

- Health insurance covering you in Germany

- Your profile has demand in Germany

If you meet all the requirements, you can make an appointment at the German embassy in your country to start your visa application (75 EUR).

With the issuance of your visa for self-employment, you will then book your flight and apply for the residence permit for self-employment in the city where you live.

This graphic from the German government shows the process step-by-step.

🏠 Address registration (Anmeldung): As soon as you find your permanent accommodation, you must register it at your local Resident’s Registration Office ‘Bürgeramt/Einwohnermelderamt’. You will then receive your registration certificate (Anmeldebestätigung). You will need this document to open your bank account or register at the local library, so keep it safe!

Once you have your “Anmeldebestätigung” for your address and your freelance visa, you’re ready to register with the tax authorities (Finanzamt) as a German would do (See process above).

#3 Figuring out Health insurance

Germany has two options for health insurance – public (statutory) and private.

Public insurance amounts to 14.6% of your income, plus an additional contribution rate of 1.3% (average).

The minimum contribution payable is around €160 (+1.3%) and the maximum is around €710 (+1.3%).

If you decide to voluntarily become a part of public health insurance, you will have the option to pick between different public health insurance providers (Krankenkassen), too. Among them are AOK, BKK, TK, BARMER, and more.

Private insurance is only available for people who fit a certain criteria, freelancing being one of them.

The rate you pay here is based on your health profile and risks. Generally, it’s cheaper for young professionals but could become more expensive as you get older. Also, note that your family won’t be covered here.

It’s advisable to check different alternatives and coverage included before making your decision. There are many private health insurance companies in Germany you could choose from. Among them are DKV, Axa, Allianz, Ottonova, and more.

If you’re applying for a Self-employment Visa, you’ll need your health insurance before you move to Germany or even before you apply for your Visa. This is because your Visa application requires you to have a certain amount of health coverage. Cheaper ex-pat policies available for visa applicants might not fulfil all the requirements for the immigration office, please make sure your provider does.

Before making your decision about your health insurance make sure you check:

- Contribution fee

- Coverage and services included

- Contract terms

- Family coverage

- Support

- Bonuses

You can always opt for public health insurance and supplement that with a private health insurance plan. Try and look for one that covers accidents as well or consider getting private liability insurance ‘Haftpflichtversicherung’.

Freelancers will pay the health insurance 100% on their own (only artists can apply for the KSK to get a cheaper option).

Do you usually travel while working?

Explore SafetyWing’s Remote Health plan and get 40% off if you sign up through freelancermap.

➞ Goes with you wherever you live, work or travel in 175+ countries

➞ You can see any doctor at any clinic or hospital, public or private

➞ 0% deductible and an annual coverage of 1.5 million USD

… and more!

#4 Insurance and pension

Freelancers must arrange all insurance policies by themselves. And unfortunately, it doesn’t end with health insurance.

The following insurances are also particularly important for a freelancer:

- Accident insurance (Unfallversicherung)

- Retirement (Altersvorsorge)

- Occupational disability insurance (Berufsunfähigkeitsversicherung)

- Professional liability insurance (Berufshaftpflichtversicherung)

- Public liability insurance (Betriebshaftpflichtversicherung)

- Commercial legal protection (Gewerblicher Rechtsschutz)

- Business contents insurance (Geschäftsinhaltsversicherung)

Freelancers can voluntarily pay into the state pension insurance (Rentenversicherung) but this is not mandatory (only some liberal occupations must pay it). Inform yourself at an early stage of your options and invest wisely to retire without worrying when you plan to.

According to our 2022 study, 58% of freelancers in the DACH region are paying into the state pension. Other alternatives of saving money for retirement include:

- Shares, ETLs, funds, etc: 58%

- Real estate: 54%

- Private pension: 43%

- Life insurance: 33%

#5 Opening a bank account

Although it’s not mandatory to have a separate bank account for your freelance business, it’s highly recommended.

There are different bank accounts for freelancers worth checking out.

Some of the most popular options in Germany include DKB Bank, N26 or Revolut. To open your bank account in Germany, you’ll need:

- Your passport along with your Visa (if applies)

- Anmeldung – proof of address

- Evidence of your income

When working with international clients and different currencies, there are cheaper alternatives to get paid than regular bank transfers.

For example, if you are working with clients in the UK or the US, we’d highly recommend checking the Wise account. It’s free and allows you to invoice like a local in 10 different currencies.

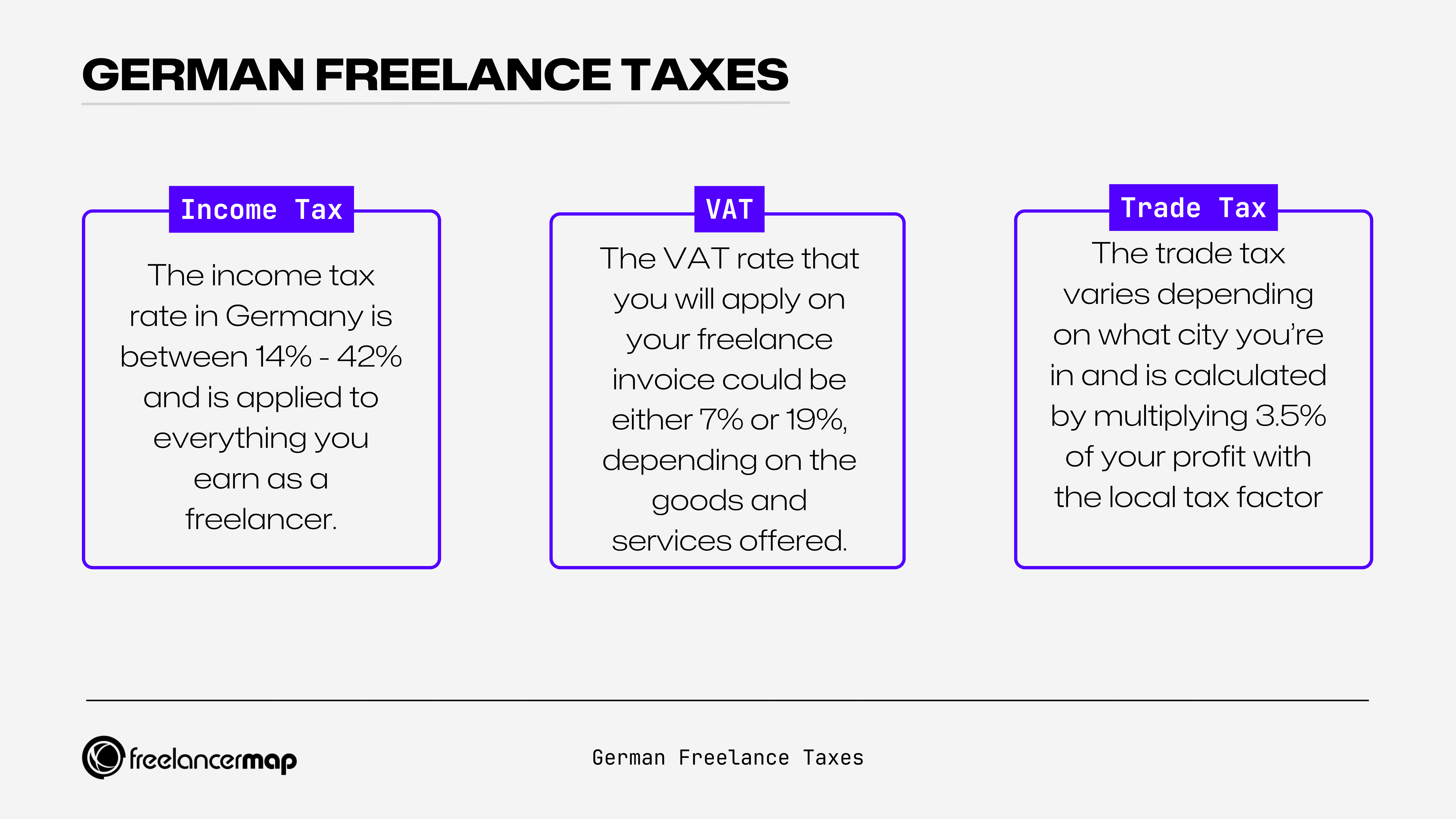

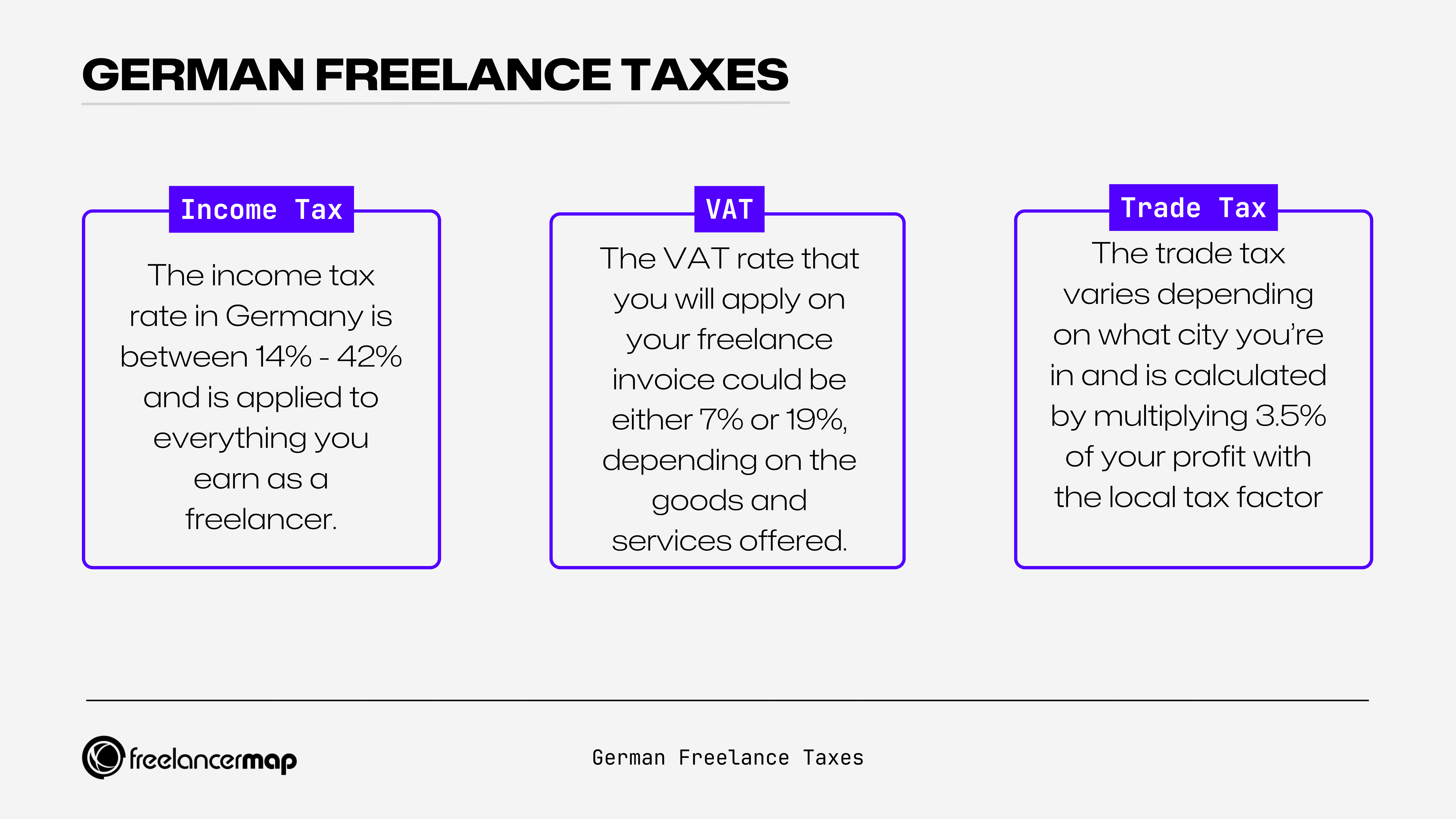

#6 German freelance tax: Your tax obligations

As mentioned above, if you’re working as a Gewerbe, you’ll need to pay trade tax but are exempt from it if you’re working as a Freelancer. You are, however, subject to income tax and VAT.

Income tax (Einkommensteuer)

The income tax rate in Germany is between 14% – 42% and is applied to everything you earn as a freelancer.

To pay your income tax, you’ll need to create either an income surplus invoice or a profit and loss statement (Einnahmenüberschussrechnung (EÜR)). This document shows the difference between your income and your expenses and defines your taxable income.

Join our IT freelancer community today! Create your freelance profile in just 2 minutes.

Your freelance activities will be subject to income tax only if your taxable income exceeds €10,908 (Tax free amount “Grundfreibetrag” in 2023).

Freelancers need to pay their income tax upfront on a quarterly basis to your local tax office ‘Finanzamt’. It’s an estimation and at the end of the year, based on your tax return, the actual amount of tax will be determined.

If you paid too much, the difference will be paid back to you or you might need to make an additional payment if it was less than what it should.

As your profits increase, so will your tax rate for your income. So it’s highly recommended to set extra money aside for taxes in case your profits increase.

VAT (Mehrwertsteuer, Umsatzsteuer)

All self-employed individuals in Germany are subjected to pay VAT or ’Umsatzsteuer’ .

The VAT rate that you will apply on your freelance invoice could be either 7% or 19%, depending on the goods and services offered. Also, that would be the rate you’d pay in other invoices.

You will deduct the VAT you paid from the VAT you received from your invoices. If you paid more than you receive, the Finanzamt will refund the difference and otherwise, you’ll need to pay it to the Finanzamt.

VAT declarations need to be prepared periodically (monthly, quarterly or yearly). At the end of the year, you are allowed to file claims on said goods and services.

💡 You can easily pay your VAT tax through the official portal of ELSTER.

Exception: Kleinunternehmerregelung” (The small business rule)

Some freelancers will have the option to adopt the “Kleinunternehmerregelung” to not add VAT (Ust) on their invoices if they are not earning more than €22.000 this year, and no more than €55.000 the next one.

Trade tax (Gewerbesteuer)

The trade tax or ‘Gewerbesteuer‘ varies depending on what city you’re in. Sole proprietorships and corporations are all subjected to this tax.

Trade tax only applies to self-employed traders and NOT to freelancers. It is also paid to the ‘Finanzamt’ as part of the tax declaration. However, If your annual revenue is less than 24,500€, you are exempt from trade tax.

So how much tax do I pay for freelancing in Germany?

- Einkommensteuer – 14% – 42% once a year

- Umsatzsteuer – VAT difference, monthly, quarterly or yearly

#7 Tax return (Steuererklärung)

As a freelancer, you’ll need to fill out your income tax return (Steuererklärung) by July 31 of the following year.

As a self-employed person, there are certain expenses you can deduct from your tax return.

For example:

- Tax advice costs (Steuerberater, software, etc.)

- Business travel costs

- Marketing costs

- Office and equipment

- Health, liability insurance

- Church tax

- Donations

- Medical expenses

You can do this on your own electronically on ELSTER and you’ll need to fill out different forms as a freelancer such as Anlage S or Anlage USt if you pay VAT.

However, many freelancers decide to have this done by a Steuerberater because they are trained to optimise your return.

#8 Invoicing and bookkeeping

Your freelance invoices need to be professional and include some mandatory information in order to be accepted by the tax office (Finanzamt), your German clients or your tax advisor (Steuerberater).

Mandatory details to include in your freelance invoice:

- Freelancer’s name and address

- Tax number (Steuernummer)

- VAT ID (Ust ID), if applicable (no Einkommensteuerregelung)

- Client’s name and address

- Invoice number (ideally a client’s number too)

- Date of the invoice

- Description of the service provided: number of hours worked, tasks performed, duration of the service, etc.)

- Price of the service

- VAT if applicable (If VAT don’t apply include a sentence mentioning why)

- Total amount (Net amount + VAT = Gross amount)

- Bank details or instructions to make the payment

There are some other details that we’d recommend you include, such as payment terms. Late payments are unfortunately a reality for many freelancers, so this reminds them about the agreed conditions.

You can download our free invoice template and read through more tips around invoicing as a freelancer.

Having your own business sometimes means spending more time with bookkeeping than doing your actual job.

That’s why it’s important to find a system that allows you to keep an eye on your finances. This can be an Excel if it works for you, but there are also good accounting software for freelancers that can help you with this.

Some alternatives to check out:

- HelloBonsai (7-day free trial)

- Quickbooks

- Freshbooks -> Fastbill in Germany

Another very popular option in Germany is to hire a Steuerberater (tax advisor) that can help freelancers with their accounting, tax return, bookkeeping, etc.

Although this alternative might seem expensive, they often help optimise your expenses and maximise your tax return so that the benefits offset the cost of it (and you claim the expenses in your tax return!).

So you’re now registered and know about your obligations. But what do you miss?

CLIENTS! Let us help you with that!

Join 58.000+ professionals in Germany and get connected with amazing clients

– Free freelancer profile

– 4,000 new projects published every week

– Digital and tech projects

– Local and international clients

– Get paid the 100% of what you agree with the client

– Use your regular tools and processes

– Personal support

> Sign up for free

Early retirement + freelancing: Perfect combo since 2023

Early retirement and freelancing make a perfect combo since the beginning of 2023, as the additional earnings limit for early retirees in Germany has been abolished.

Before, pensioners were only allowed to earn an additional 46,060 € per year (gross) without a reduction, so this change is especially beneficial for those in sectors with high average incomes, such as IT and engineering.

Professionals with a lot of work experience can continue working after retirement on their own terms and take advantage of the flexible schedule and increased income. On the other hand, companies are attracted to experienced professionals as they are usually well-established in their careers, have accumulated a lot of expertise, and have a confident demeanour.

“For me, freelancing was a chance to start something new again, and I’m happy to stay in touch with young people through it. It also keeps me young,”

Michael R., a 63-year-old IT consultant, 30+ years of experience in an automotive company.

Early retirees, like Michael, can compensate for the loss of the pension they incur by retiring before the age limit.

In Germany, anyone who has paid more than 35 years into pension funds and then retires earlier will have their entitlements reduced by 0.3% per month for life. Only those with more than 45 years of contributions are not affected by the reduction.

This change represents a major opportunity, particularly for companies in the IT and engineering sectors, which are already severely affected by the shortage of skilled workers.

Before taking the plunge, however, early retirees should seek tax and legal advice on possible tax and organizational consequences. False self-employment (Scheinselbstständigkeit) must be avoided, and fees and pensions may be taxable. Pension entitlement does not automatically increase because of self-employment, but voluntary contributions are possible and increased contributions may be due for those with statutory insurance.

FAQs related to freelancing in Germany

Can I freelance as a student in Germany?

Yes, you can freelance while studying in Germany, but you’d need to check in with your health insurance provider to see if you’ll still have access to the reduced rate that you’re paying. Generally speaking, if you work less than 20/week you won’t need to pay your health insurance contribution yourself.

Can I freelance on the side while working full-time?

Yes, but if you want your employer to keep paying for your health insurance (Krankenkasse) you won’t be able to do more than 18 hours extra. And, do not forget to get the approval from your employer first (it’s probably written in your contract “Arbeitsvertrag”).

Where can I find freelance clients in Germany?

According to our study, acquiring projects is one of the biggest challenges for freelancers in the DACH region (and the rest of the world).

It takes time to find projects and the time spent on that cannot be ignored. Ultimately, the longer it takes a freelancer to find a project, the longer they don’t have earnings.

Here’re our tips to find companies hiring freelancers in Germany:

- Work on your personal brand

- Create a profile on established German freelancing platforms (like freelancermap)

- Be active in communities and events

- Reach out to past employers

- Work through agencies, such as

Are there any deadlines or dates I should be aware of?

Keeping track of important dates related to your taxes and so can be the difference between achieving your desired results or falling short of them.

As a freelancer, there are not many mandatory deadlines to remember and since most of them recur periodically, you can save them in your calendar. However, it is important to double-check the dates for accuracy.

Useful German words around freelancing translated

If German is not your native language, it might be intimidating (especially Business German), so here is a table of common German words you need to know as a freelancer and their translations in English.

| Freelancer | Freiberufler, freier Mitarbeiter, Freelancer, or Gewerbe (understand the differences here) |

| Trade tax | Gewerbesteuer |

| German trade register | Handelsregister |

| Contract | Werkvertrag |

| Freelancer registration | Freiberufler anmeldung |

| Tax ID | Steuernummer or Ust. Nr. |

| Tax Advisor | Steuerberater |

| VAT | Mehrwertsteuer |

| Address registration office | Einwohnermeldeamt |

| National ID / Passport | Personalausweis / Resisepass |

| Address certification (if you live in a rented place) | Wohnungsgeberbestätigung / Vermieterbescheinigung |

| Address registration | Anmeldung bei der Einwohnermeldeamt |

| Change of residence form | Ummeldung des Wohnsitzs |

| Registration certificate | Anmeldebestätigung |

| Tax authorities | Finanzamt |

| Income tax | Einkommensteuer |

| Tax office | Finanzamt |

| Tax return | Steuererklärung |

| Revenue | Umsatz |

| Advance VAT return | Umsatzsteuervoranmeldung |

| Kleinunternemerregelung | Small business rule (to not add VAT) |

| Krankenkasse | Health insurance company |

| Haftpflichtversicherung | Liability insurance |

We hope this guide helps you get started. Let us know if you have any questions down below!

You might also like:

- The IT freelance market in Germany [Insights]

- 8 Key Tax Deadlines For Freelancers in Germany (Update 2023)

- NDA for freelancers

- How to become a freelancer in SAP

More guides: How to: Freelancing In Portugal | How To: Going Freelance In The UK

Hi,

Is German freelancing/self employment visa also applicable on people who have clients outside germany as i am working remotely for a dubai based company on monthly fixed salary. Am i eligible for self employment or freelancing visa.

Hi Mohsin, thanks for your comment.

I think you won’t be eligible for a self-employment or freelancing visa in Germany if you are working for a company based in Dubai with a monthly salary. That kind of visa is for people who are self-employed or freelance, and are performing work inside Germany. One of the requirements is that there is an economic interest in Germany for your profession/business.

However, I would highly recommend that you reach out to the German Embassy in your country to find out more information. They can provide you with information about the visa requirements, and whether you meet the criteria for application.

Good luck!

Hallo

I currently applied for the Freelance license, and when it comes to charge my clients i’m a lit bit confused to charge VAT 19% or 7%?

Thank you and best regards

The VAT rate you charge depends on the type of service you provide. The standard VAT rate in Germany is 19%. This rate applies to most goods and services, including consulting, marketing, and other professional services. There is a reduced VAT rate of 7% that applies to certain goods and services, such as books, newspapers, food, and some medical supplies. Which services are you providing?

Thank you for your fast response!

I provide photo shooting, Video Shooting, Social media design and management, And web design

Thank you againg and best regards,

Ahmed Fekry

It’s probably 19%, but we recommend seeking the advice of a tax consultant to ensure you charge the correct VAT in this case.