A tax consultant or tax advisor helps companies and individuals prepare and optimize their tax returns. They also represent clients to resolve potential tax issues. Let’s take a closer look at what a Tax Consultant is and what it is they do!

The role

Battling with your taxes is a challenge in and of itself. Struggling to figure out what every form means or what the financial jargon is referring to? That’s where you would call in a tax consultant. Such an expert is professionally able to oversee the sometimes complex requirements of the tax system and can, depending on the scope and type of the tax return, claim strong benefits that remain hidden from the average person due to a lack of knowledge.

Looking for a Tax Advisor?

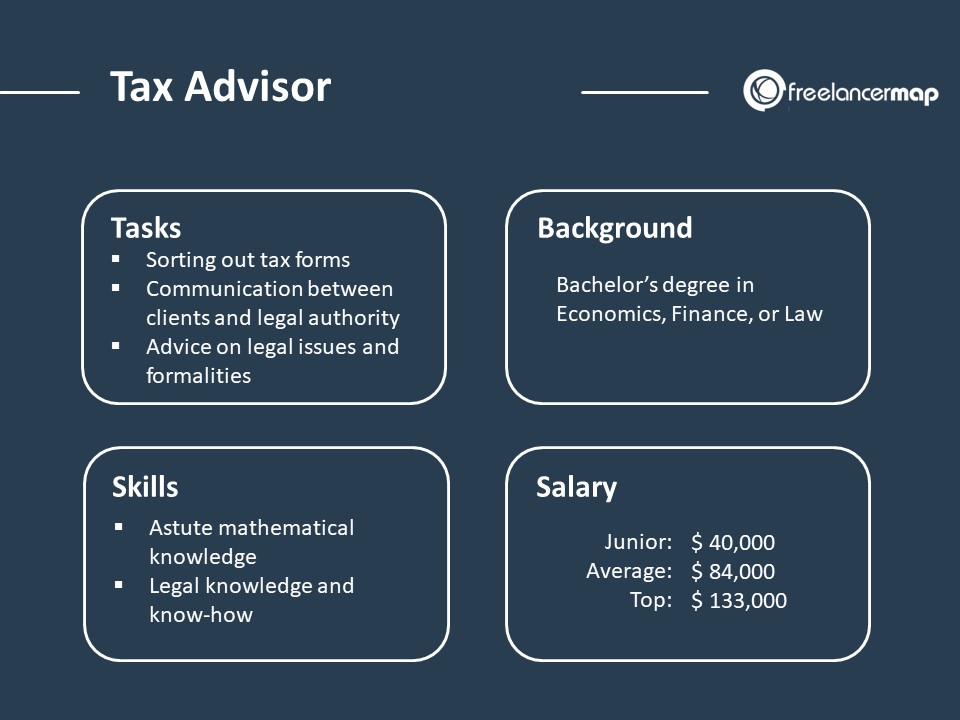

Responsibilities

Tax consultants have legal know-how and knowledge of accounting in companies as well as various possibilities to save taxes for their clients in certain situations.

In addition, they help founders to establish their companies and communicate on behalf of their clients with public authorities – tax courts and authorities – if necessary.

Tax advisors are therefore often in correspondence with their clients and the authorities. They arrange and process the necessary tax documents and, if necessary, request missing papers or details.

They also advise on financing and legal issues. The activities of tax consultants are in demand across all industries. Depending on the client, the tax advisor will respond to the specific needs of companies from different legal forms or private clients from the type of employment or self-employment.

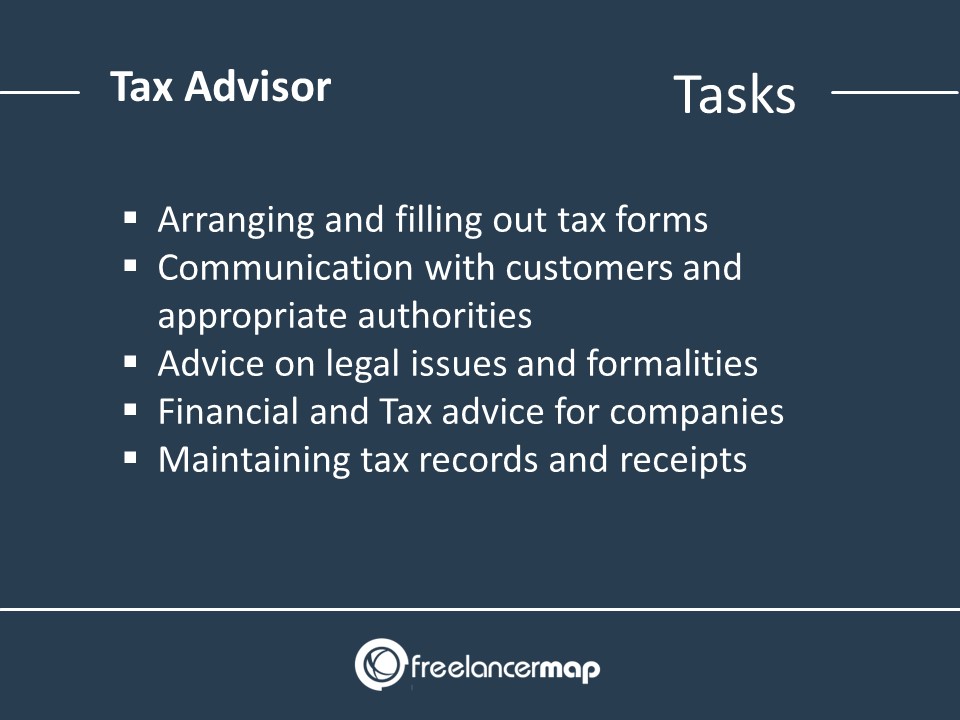

What tasks do tax consultants have?

- Arranging and filling out tax forms

- Communication with customers and authorities

- Advice on legal issues

- Advice for founders in terms of company creation

- Accounting services

Hard Skills and Soft Skills

The hard skills of tax consultants include both mathematical and legal knowledge. In addition, professionals must offer their clients good and comprehensible advice.

Therefore, they must be able to communicate complex facts in a simple and understandable way. They work independently and have a high sense of responsibility. The tax return is of great importance for private individuals as well as for companies and is a decisive factor in the financial situation of those affected.

What must a tax consultant be able to do?

- Mathematical knowledge

- Legal knowledge

- Comprehensible communication of complex facts

- Reliability and a sense of responsibility

- Accounting skills

Background – How do I become a Tax Advisor?

There’s more than one way to get a job as a Tax Consultant. One option is to train as a tax clerk, another is to study. The study courses can have different names. A selection: Tax theory, business studies with a focus on taxes, finance, accounting or taxation. In addition to economists, it is above all lawyers who can acquire the knowledge they need to become tax consultants through optional subjects in the field of tax law.

The role of a tax consultant is regulated differently across the world.

- In Germany (and Austria) the Steuerberater is the professional license for a tax consultant.

- In Spain, the Tax Advisor is an Asesor o gestor fiscal and they provide assistance not only in terms of taxes but also business management, business law or administrative matters.

- In Japan, they have a specific license called 税理士 zeirishi, and you must pass a special state exam.

Looking for a new job?

Salary

The starting salary is around $42,000 gross per year. The average salary is around $85,000 euros. Anyone who receives a senior salary receives up to $184,000 or more per year.

The salary of a tax consultant can vary greatly depending on the company. It also plays a role in whether the income comes from being self-employed or having full-time employment. Successful self-employed people can often earn considerably more than their salaried colleagues.

How much does a tax consultant earn?

| Junior | $42,000 |

| Average | $85,000 |

| Senior | $184,000 |

| Average rate Tax Consultants (2022) | $81/hr |

On average, freelance Tax Consultants charge $81/hour (freelancermap’s price and rate index in September 2022).

Freelance rates in Tax Consultancy range between $66 and $96 for the majority of freelancers.

Considering a freelance rate of $81/hour, a freelancer would charge $648/day for an 8-hour working day.