Freelancers face unique challenges when it comes to protecting themselves and their businesses. Insurance for freelancers is not only essential for safety, but in 2025, it’s becoming a legal necessity for many.

Whether you’re a freelancer in the creative sector, IT, or consulting, understanding the freelance insurance landscape is critical.

- Do I need insurance as a freelancer?

- Insurances for freelancers and self-employed

- Common claims among freelancers

- Emerging risks

- Why do clients ask you to have insurance to work with them?

- What insurance do I need? Recommendations

- Key takeaways

Do I need insurance as a freelancer?

Freelancers are responsible for their income, their health coverage, and their business’s liabilities.

Without the safety nets of full-time employment, insurance becomes essential for:

- Health protection: To ensure you’re covered in case of illness or injury.

- Liability coverage: To protect yourself from legal actions, especially if a client claims damages or errors in your work.

- Income security: To safeguard against periods of low or interrupted earnings.

- Legal compliance: Some countries in the EU mandate specific types of insurance.

In short, insurance is a vital tool for mitigating risks and ensuring that your freelance career remains financially stable and legally compliant.

So, is freelance insurance mandatory?

Consider this – you’ve taken on a big-time project worth tens of thousands of dollars. You’re all set to finish up soon but you’re faced with sudden equipment failure which leads to a failed project. The unhappy client then decides to sue you for the entire cost!

Now what?

There will likely be a legal case, even though it wasn’t your fault. And you’ll have to pay tens– or hundreds – of thousands of dollars in fees and damages. This is where having insurance would have changed the situation entirely.

Freelance insurance is something that you need to consider depending on where your freelance business currently stands. E.g Smaller-scale freelancers that do not actually deal with big-time projects cannot really justify the cost of insurance.

But if you’re a freelancer who works on big projects, having insurance might just be in your best interests. Also, clients will sometimes ask you to have insurance if you want to work with them.

Are they anticipating that the project will fail by including a clause in the contract asking you to indemnify them for any loss, liability, damages or expenses arising from any breach of the agreement?

Not really. However, as a company, they have their reasons when they ask you to be insured before starting working.

Join our freelancer community today!

Create your profile in just 2 minutes and start attracting new clients.

What insurance do freelancers and self-employed need?

1. Professional liability insurance

Professional Liability Insurance or Professional Indemnity Insurance or otherwise also called Errors and Omissions (E&O) Insurance is one of the most common types of insurance used by freelance professionals.

It protects you against clients suing on the basis of product negligence due to an accidental omission, an error or even slander. Some big businesses actually require that you have this type of insurance before agreeing to work with you.

What does Professional Liability Insurance cover?

- Intellectual Property

- Damage to persons, materials, and property

- Possible costs resulting from legal proceedings

- Data protection

- Legal defense costs

- Economic loss to the client due to the damage (consequential damages)

How much does the liability insurance policy cost?

Annual premiums vary significantly depending on the country and the coverage. Taking the case of a developer, and considering insuring €250,000, the approximate premium could range between €180 and €250. For those with higher revenues or a larger number of clients who want to insure, for example, €600,000, the premium would be closer to €500 to €750.

Real-life example: María, a freelance web developer, took out a liability insurance policy with coverage of €250,000 for €200 annually. At one point, a programming error in an online store caused the client to suffer losses because the store wasn’t available during the launch of a campaign. Her liability insurance covered both the €35,000 in compensation and the €8,500 in legal expenses.

Coverage levels in Europe

- Minimum coverage: €250,000 (suitable for smaller projects)

- Standard coverage: €1,000,000 (required by most corporate clients)

- Premium coverage: €2,000,000+ (for high-risk or high-value work)

One of the top providers that specialises in European freelance insurance is exali, that offers coverage for freelancermap members at a discounted rate. Depending on location, freelancers can get their policy at just €126.20 net per year.

2. Public liability insurance

Public Liability Insurance protects you in case someone, e.g. a client suffers personal injury or property damage as a result of your business activities.

But do freelancers really need liability insurance? IThis type of coverage is especially relevant if:

- You host workshops or trainings in physical locations

- You meet clients in person (e.g., at your office or theirs)

- You attend events, trade shows, or networking sessions

- You rent office or coworking space

In many countries and industries, Public Liability Insurance is not legally required for freelancers. However, some clients may insist on it, especially for in-person work or in areas like:

- Event management

- Photography or videography

- Consulting or coaching (with in-person sessions)

- IT support or tech installation

However, if you work from your home and don’t usually invite clients over, the risk of injuring someone at your work premises is probably not high enough to justify the expense.

3. Home and Contents insurance

If you work from a home office, you may want to consider home insurance and verify whether it covers your office and equipment. Sometimes they do, but sometimes they don’t.

Most of the time, they cover anything, apart from more professional items like photography equipment. If the latter is the case, a contents insurance might be a good way to protect your property.

If your work equipment is likely to cost a substantial sum to replace in the event of a fire or robbery, this type of insurance will cover it. It depends on the tech you have, e.g. a 1,000 dollar laptop alone probably doesn’t justify contents insurance.

A Freelance Content and Equipment Insurance protects your work tools against:

- Theft or robbery

- Accidental damage

- Electrical or electronic breakdowns

- Data loss

What are the costs of this insurance?

The premium depends on the insured equipment. A basic coverage for up to €3,000 in equipment could cost between €120 – €200 annually. For example, to cover €10,000 worth of equipment, including servers, the cost could range from €350 to €500 per year.

Real-life example: Manuel, a full-stack developer, took out insurance for his equipment valued at €4,500 (laptop, professional monitor, iPad, and smartphone) for €245 annually. When his backpack with the laptop and tablet was stolen during a business trip, the insurer reimbursed him €2,800 to replace the equipment in less than 10 days, allowing him to continue his projects with minimal interruption.

4. Health insurance

In Europe, public health insurance is a key component of many countries’ healthcare systems, and freelancers often have to contribute to this system. However, the rules regarding whether freelancers must be on the public system vary from country to country:

#1 Germany

Germany has one of the most complex freelance health insurance system. Freelancers in Germany can voluntarily sign up for public health insurance (income-based) or private health insurance, which offers more flexibility.

Comparison: Public vs Private Health Insurance in Germany

| Public (GKV) | Private (PKV) | |

| Entry age 30 | €220-400/month | €250-400/month |

| Entry age 40 | €220-450/month | €350-600/month |

| Entry age 50 | €220-500/month | €500-800/month |

#2 France

Freelancers, known as auto-entrepreneurs, must pay into the Sécurité Sociale (public health system). This covers medical expenses, but many freelancers opt for additional private insurance for more comprehensive care.

#3 Spain

Freelancers in Spain must also contribute to the Social Security system, which includes health coverage. However, many freelancers choose to add private insurance for quicker access to specialists or additional services.

#4 Netherlands

Freelancers are legally required to take out basic health insurance Zorgverzekeringswet (Health Insurance Law), which covers essential medical care like hospital visits, surgery, and medication. The average cost of basic insurance in the Netherlands is around €100 to €130 per month. Many freelancers opt for additional coverage for services like dental care, which can cost an additional €20 to €50 per month.

#5 Portugal

Freelancers in Portugal must contribute to the public Social Security system (Segurança Social), with monthly contributions around €200 to €300 depending on income. For private insurance, freelancers typically pay between €30 and €120 per month for supplemental coverage, depending on their needs.

Do freelancers opt for additional private Health Insurance?

While many freelancers are covered by public health insurance, many opt to supplement this coverage with private health insurance for a range of reasons:

- Faster access to care: Public systems often involve long waiting times for appointments, so private insurance can help freelancers access care more quickly. This is especially true in countries like Germany, France, Spain, and Portugal, where public systems are effective but may require longer waiting periods for non-urgent treatments.

- Better coverage: Private insurance can fill gaps in public healthcare systems, including dental, vision, mental health, and alternative therapies. In France, for example, the public system reimburses only a portion of dental or optical expenses, so private insurance is often used to cover these additional costs.

- Personalised care: Private health insurance policies often offer more flexibility in choosing healthcare providers, which is crucial for freelancers who need to ensure they receive top-quality care without long delays.

Real example: Elena, a 32-year-old freelance developer, takes out private health insurance for €60 per month, which includes 12 annual physiotherapy sessions. After spending long hours in front of the computer, her back is often sore, and she particularly appreciates the physiotherapy coverage included in her policy.

Health insurance for freelancers: Remote Health by SafetyWing

If you’re looking for health insurance that works regardless of where you live, work or travel, you should check out SafetyWing’s Remote Health Insurance. We have partnered up with them to give our members access to exclusive plans especially designed for freelancers. With Remote Health, the freelancermap community can:

- Access the best healthcare in 185+ countries

- Coverage in your home country and during long-and short-term travel

- See any doctor at and clinic or hospital, private or public

- 24/7 access to support team run by real humans

- Mental health and wellness benefits included

Log in to your freelancermap account to see the different plans available.

Just looking for short-term travel insurance?

Explore SafetyWing’s travel medical insurance: Nomad Insurance

Get coverage for accidents or emergencies while outside of your home country. Nomad Insurance includes coverage for lost checked luggage, travel delays, or trip interruptions. You can purchase Nomad Insurance while already abroad and it covers home trips and visits, too!

5. Income insurance

Income Insurance is designed to replace part of your income if you become temporarily or permanently unable to work due to health reasons — whether it’s a serious illness, accident, burnout, or long-term medical condition.

It typically provides monthly payouts based on your previous income level (usually around 60–70%), helping you cover living expenses, medical costs, or business obligations while you recover.

How much does income insurance cost?

It varies depending on age and health, profession and risk levels, or income covered. A healthy freelancer in their 30s might pay between €30–€100/month, depending on coverage level.

Tip: Policies often have a “waiting period” (e.g. 30–90 days) before payouts begin, so consider building a small emergency fund to cover that gap.

6. Life insurance

As a freelancer, your livelihood is directly tied to your ability to work. However, what happens if you’re suddenly unable to work due to illness, injury, or death? This is where life insurance becomes an essential part of your financial planning.

Keep in mind, though that the types of life insurance available to you depend entirely on the country you live in.

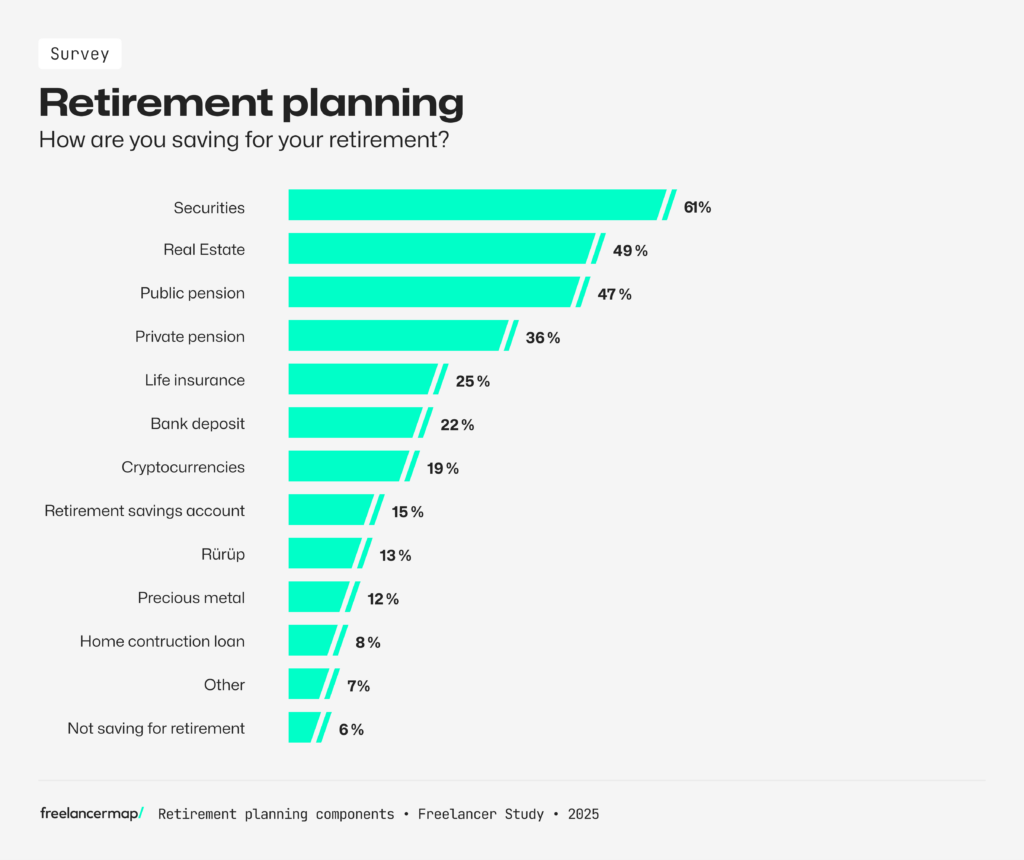

According to our latest Freelancer study, 25% of freelancers have life insurance as a component of their retirement planning:

7. Cyber insurance

Cyber insurance, also called cyber liability insurance, is an insurance policy that can help protect your business against any losses that might occur from cyber attacks and cyber crimes.

Because cyber attacks are becoming more common and sophisticated these days, you should consider getting cyber insurance for your business. All it takes is one hack to jeopardise your company data or even worse, that of your customers.

Depending on the insurance provider you choose, the exact losses that are covered can differ though generally, cyber insurance can cover:

- Data breaches involving sensitive information

- Business interruption losses

- Cybersecurity and privacy liability

- Crisis management

- Media liability

The most commonly used ransomware strategies by cybercriminals that affect SMEs and freelancers are:

- Phishing: Emails impersonating trusted identities to deceive victims.

- Exploit of vulnerabilities: Searching for flaws in programs to infiltrate systems and access information.

- Extortion: In addition to accessing data, threats to publish it if no financial compensation is made.

Real example: Ana, a freelance developer specialised in e-commerce, took out cyber insurance for €380 annually. During a project, her team suffered a ransomware attack that encrypted all of their files. The insurance covered the services of a cybersecurity specialist (€2,200), data recovery (€1,800), and compensation for downtime (€3,600), preventing a loss that would have seriously jeopardized her business.

Most common claims by freelancers

Over 90% of claims reported to exali involve pure financial losses, primarily in the following categories:

- Legal infringements (approx. 40%)

- Non-performance or poor performance, resulting in compensation claims (approx. 27%)

- Cyber incidents (e.g., hacker attacks)

- First-party losses, such as premature project termination

Mistakes can happen, but freelancers can protect themselves by ensuring their contracts include key clauses that clearly define responsibilities and expectations. For example:

- A clause stating that the client must sign off on each stage of the work

- A clause acknowledging that bugs are inevitable, and outlining your responsibilities for bug fixing

- A clear definition of project scope and delivery dates, to avoid disputes related to time management or unmet expectations

Emerging risks freelancers should know about in 2025

The freelance landscape is changing fast, and with it, so are the risks. As independent professionals take on more complex and high-stakes projects, it’s important to stay ahead of new challenges that could impact your work, your clients, and your reputation.

Our insurance partner exali has identified several emerging risk areas that are becoming increasingly relevant for freelancers across industries:

1. Generative AI and Copyright infringement

With AI tools now part of everyday workflows (from content creation to coding), freelancers face a new type of liability: copyright issues. If AI-generated work unknowingly violates intellectual property laws, you could be held responsible. Make sure your tools and outputs are reviewed, and understand your liability before hitting “send.”

2. Cyberattacks and data breaches

Cybersecurity is no longer just a concern for big corporations. Freelancers working with sensitive client data, especially across platforms and borders, are also at risk. The good news? With exali, third-party cyber damages are automatically covered in their Professional Indemnity policies — a crucial layer of protection in today’s remote work environment.

3. ESG Misadvice (Environmental, Social, Governance)

As more clients align with ESG goals, freelancers (particularly consultants), may be asked to provide strategic input or reporting. But if advice leads to reputational damage or non-compliance, you could be held liable. ESG is not just a buzzword; it’s a growing risk category.

4. Platform liability

Working through third-party platforms can open up freelance opportunities (and legal grey areas). Disputes over deliverables, unclear contract terms, or platform-specific obligations may leave freelancers exposed. Be sure you understand who’s responsible for what, especially when working internationally. Platforms, like freelancermap, are designed to give freelancers full control over how they work. Freelancers can connect directly with clients and negotiate their terms, including scope, deadlines, and payment.

5. Project delays and missed deadlines

In today’s fast-paced project environments, a delay (even for reasons outside your control) can have financial and legal consequences. Clients expect results, and if they suffer losses due to a late delivery, you could be asked to compensate.

Why do clients ask you to have freelance insurance to work with them?

Because working with an insured professional is way safer for them.

Hiring a freelancer can be risky for companies, as the responsibility for the job lies heavily on the freelancer and any mistake or misunderstanding can result in the company suffering financial losses.

According to exali’s experience, approximately 60-70% of large companies in Europe (with more than 250 employees) require proof of Professional Indemnity Insurance before working with freelancers.

This means that if the freelancer fails to meet the standards or is late in their deliverables and they are insured, damages can be covered.

According to exali’s network (particularly pan-European project platforms), clients typically require a minimum coverage of €250,000 for financial losses – often even up to €1 million.

When discussing the insurance clause with your client, ensure they are aware of the extra fees associated with a higher level of coverage. Some clients might have standard clauses asking for a high level of coverage (e.g. €10,000,000 professional and public indemnity insurance), that is an unnecessary level of coverage for the majority of freelancers.

Propose a lower level of coverage (something around €250,000 – €1,000,000) and explain why you believe this is a sufficient level – if necessary, you can explore the option of raising the coverage for certain projects or situations.

Remember, the less insurance coverage you take out, the less the cost for you.

Annual premiums (for sole traders with up to €250k in revenue) vary significantly depending on the country. In German-speaking regions, coverage of €1 million for financial losses is available for a few hundred euros per year, whereas in other countries the annual premium may exceed €1,000.

Client contract insurance clauses

An insurance clause in a freelance contract typically outlines the type and amount of coverage the client expects you to have – usually Professional Indemnity Insurance (PI) or Cyber Liability Insurance.

These clauses are designed to:

- Protect the client from financial loss if your work causes damage

- Ensure you can cover legal costs or compensation in case of disputes

- Minimize project risk, especially for large or regulated clients

Common insurance requirements in contracts:

- Proof of coverage: Many contracts require you to provide a valid insurance certificate before work begins.

- Minimum coverage amount: Often set between €250,000 and €1 million, depending on project size and industry.

- Ongoing coverage: Some clients require your policy to remain active even after the project ends (to cover late claims).

- Territorial scope: The policy must cover work done across the client’s region — especially important for international clients.

Insurance clause example:

“The Contractor shall maintain Professional Indemnity Insurance of not less than €1,000,000 and Public Liability Insurance of not less than €2,000,000 during the term of this agreement.”

So, what insurance do I need to cover my freelance business?

Generally, insurance can be pretty helpful, but you should always try to evaluate the risk factors involved. If it is extremely unlikely that some of the situations described above will occur, your hard-earned money might be better spent elsewhere.

If you can afford them, however, and you often work with high-profile clients, some of the insurance types might be a necessity.

For freelancers operating in Europe, insurance isn’t just a nice-to-have, it’s often a legal requirement and always a business necessity. The investment in proper coverage pays for itself through client trust, contract opportunities, and peace of mind.

Having an insurer helps freelancers navigate stressful situations in case they happen.

Key takeaways about freelance insurance

- Health insurance is mandatory in most EU countries

- Professional indemnity insurance is required by 60-70% of corporate clients in Europe

- Insurance costs are tax-deductible business expenses

- Coverage levels should match your project values and client requirements (€250,000 – €1,000,000 should be enough)

- Regular review and comparison shopping can save significant money

- Start with professional indemnity, then add specialized coverage based on your specific profession and client requirements.

- Remember: the cost of insurance is always less than the cost of being uninsured when something goes wrong.

You might also like:

- Should Freelancers Sign Non-Compete Clauses?

- Intellectual Property Rights for Freelancers

- NDA for Freelancers: Non-Disclosure Agreements Explained

*Please note that this blog post should not be considered as a substitute for legal or financial advice. Each financial situation is different. The advice provided above is intended to be general and each freelancer should consider their particular financial situation before making any decisions.