Risk managers are responsible for the risk relating to corporate activities. These can include finance, control, product development, quality management or organizational and corporate development.

The Role of a Risk Manager

Although risk management as a concept originated in the financial services sector, today companies from almost every industry employ risk managers. The aim is to analyze the risks associated with major business decisions in advance and thus provide a solid basis for strategic orientation. The analysis relates to various areas, such as market conditions and developments, interest and inflation risks or the expected economic situation – always depending on the respective company.

A Risk Manager, therefore, deals with the analysis, assessment, and control of risks. They identify weaknesses that could damage a company or organization from a financial, operational or security perspective, prevent them and resolve them. They are responsible for developing strategies, processes, and systems for risk management.

The exact focus of a risk manager’s activities depends primarily on the specific business area: in banks, for example, risk management deals with the assessment of the credit default risk before a credit decision is made.

Even if the interests of the company or the various consulting firms are different, risk management pursues the same goal: keeping losses away from a company.

Examples of corporate risks:

- General external risks: Technological leaps, forces of nature, legal regulations

- Performance-related risks: procurement, sales, research & development

- Financial risks: Market prices, liquidity, currency fluctuations

- Risks from corporate governance: management style, communication, corporate culture

What are the Responsibilities of a Risk Manager?

The responsibilities of a Risk Manager are diverse and depend greatly on the industry they work in. In general, risk managers analyze and collect data to identify the company’s internal and external risks and to define the risk profile.

Based on the risk analysis, the risk manager evaluates the existing company policy and checks the risk management methods. If they encounter risks or weak points, they make suggestions for further development or change of the risk policy.

However, there are also inherent risks that cannot be completely avoided: e.g. the risks associated with working on the financial market. In this case, the risk manager has the task of defining risk appetite and developing strategies to keep risk exposure below a certain security threshold.

In addition, they must proactively identify and assess economic, social and legal changes that could impact operationally and strategically on the risk profile.

What are the tasks of a risk manager?

- Analysis and careful internal and external risk evaluation

- Assessment of current company policies and potential for risk

- Evaluation of risk management methods in place

- Risk/reward assessment based on mathematical methods

- Development of risk strategy and management

- Documentation of risk management changes

- Recommendations as a basis for management decisions

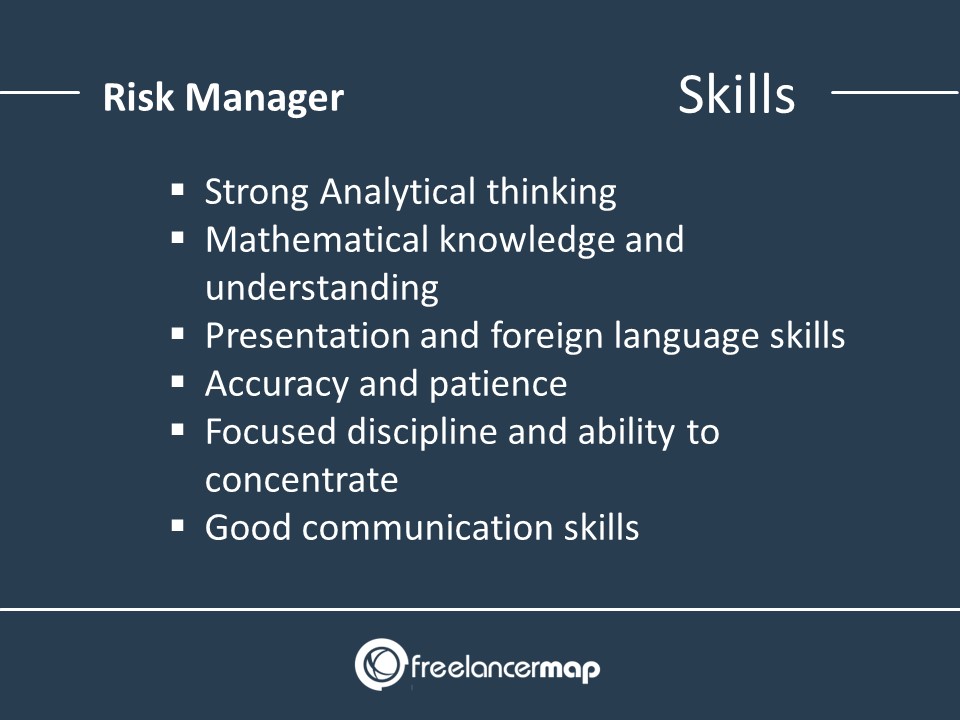

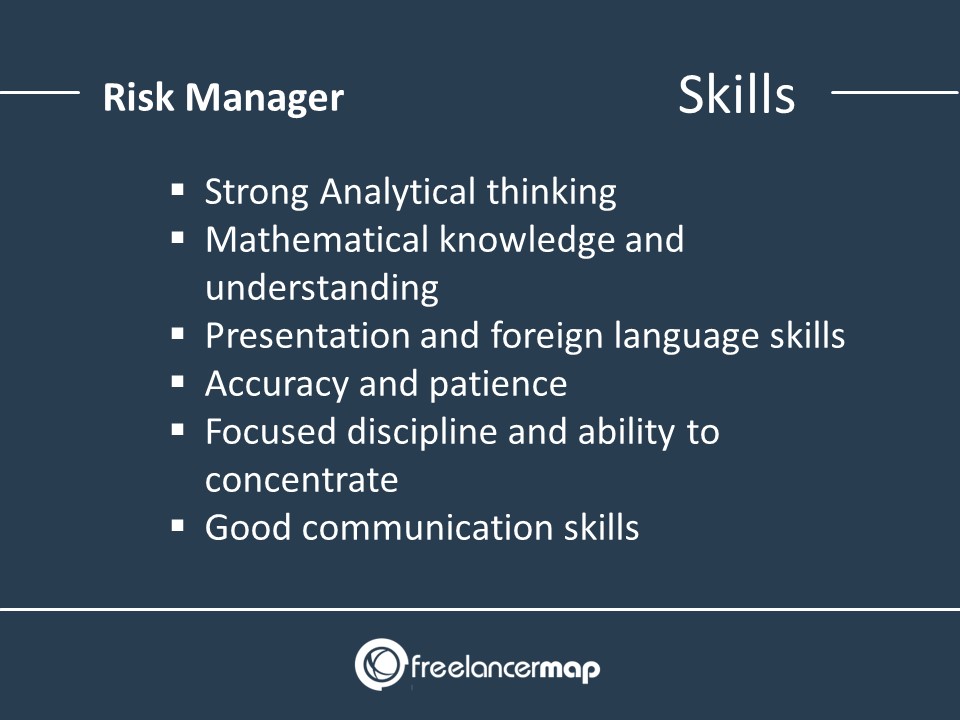

Soft and Hard Skills

What skills are asked for? You need an analytical mind to grasp complex projects and emerging issues in their entirety. Sound Mathematical understanding and knowledge is required to evaluate and assess risk calculations, and perform risk calculations.

As a risk manager, you must be able to work very carefully and with patience and accuracy. For this, you need discipline and the ability to concentrate. You are also in constant communication with employees and the management of the company. Your presentation and foreign language skills will also make your job easier.

What must a risk manager be able to do?

- Strong Analytical thinking

- Mathematical knowledge and understanding

- Good presentation and communication skills

- Accuracy and patience

- Ability to work under stress and make decisions quick

- Focused discipline and ability to concentrate

- Knowledge of the industry the company operates. e.g insurance, energy, retail

- Foreign language skills (a plus)

Looking for a new job as a Risk Manager?

» Browse the latest projects for Risk Management experts

Background and Education

Prerequisites for working as a risk manager are a sound knowledge of the industry or economics as well as solid professional qualifications in mathematics, political or regional science, information technology, or statistics.

Risk managers must show credentials in finance and mathematics and some important specializations are asset management, controller and financial advisor.

There are also several Risk and Compliance certifications that companies will be happy to see when shortlisting candidates, such as:

- ITIL

- PMI Risk Management Professional (PMI-RMP)

- Certification in Risk Management Assurance (CRMA)

- CRISC – Certified in Risk and Information System Control – ISACA Certification

Risk Manager Salary

The salary range of a risk manager is about $70,000 for beginners and $141,000 for senior risk managers. The average annual salary is around $110,000. The actual amount depends on various factors. These include the degree and any further training, professional experience and the size of the company.

How much does a Risk Manager earn?

| Junior | $70,000 |

| Average salary | $110,000 |

| Senior | $141,000 |

How much does a Risk Manager earn as a freelancer?

Risk Manager on freelancermap charge on average:

Rates range between $40 and $96/hour for most freelancers.

The daily rate for Risk Manager (8 working hours) would be around:

| Average rate Risk Managers (2022) | $96/hr |

According to freelancermap’s price and rate index in September 2022, freelance Risk Managers charge $96/hour on average.

Freelance rates in Risk Management range between $66 and $121 for the majority of freelancers.

Considering a freelance rate of $96/hour, a freelancer would charge $768/day for an 8-hour working day.

Very good info.