Financial analysts are in charge of gathering and analysing financial data and then using this data to help companies make business decisions. They track a business’s financial performance and prepare reports and projections based on their analysis. What does a financial analyst do?

Job Profile

Financial analysis is the process of using financial data to evaluate and assess a company’s performance, budget and overall financial health. As such, an analyst uses this process to identify a company’s profitability, liabilities, strengths, weaknesses, and future potential.

Financial analysts analyze a company’s data by using one of the different types of financial analysis. These include:

- Vertical analysis

- Horizontal analysis

- Liquidity analysis

- Scenario and Sensitivity analysis

- Profitability analysis

- Variance analysis and;

- Valuation analysis

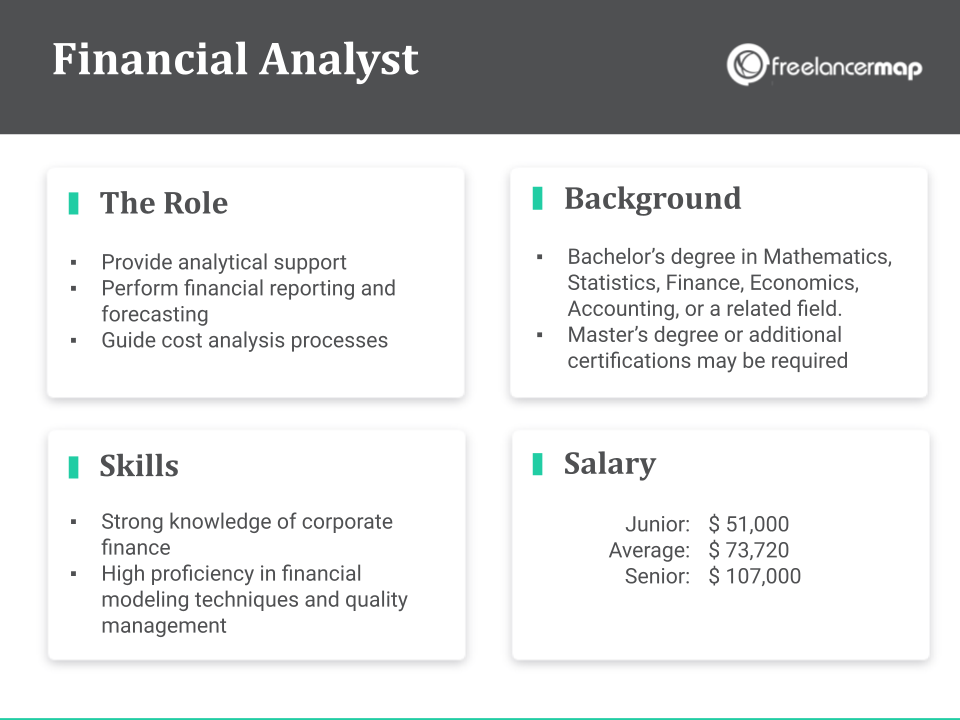

Responsibilities

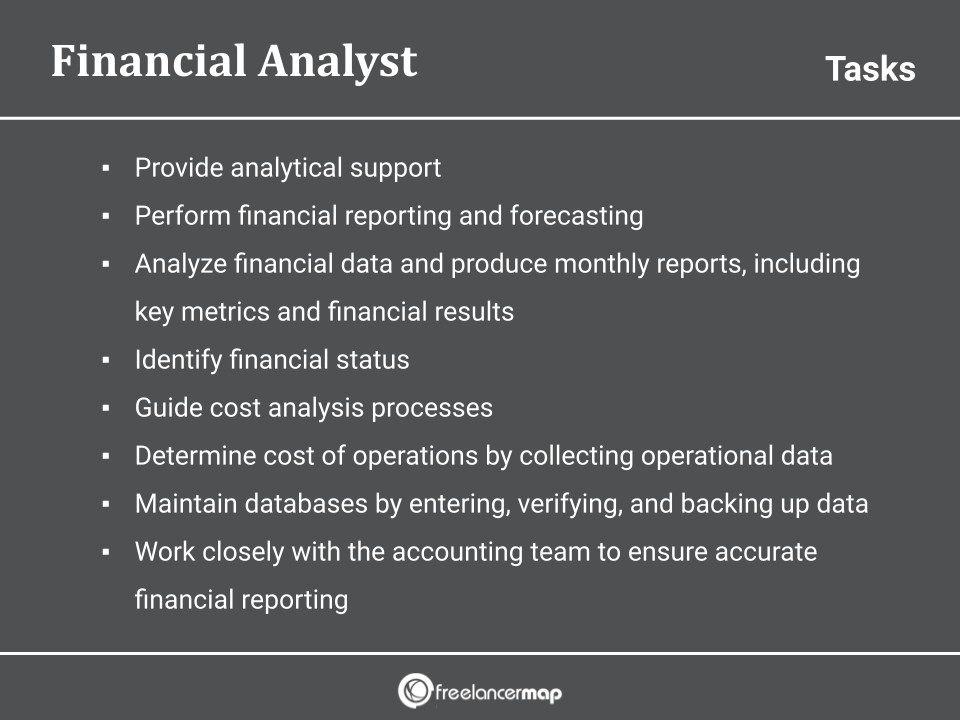

What is the role of a financial analyst? Financial analysts are responsible for providing analytical support and performing financial reporting and forecasting to senior management. They analyze financial data and produce monthly reports, which include key metrics and financial results.

They identify financial status, guide cost analysis processes, and determine cost of operations by collecting operational data. These analysts also maintain databases by entering, verifying, and backing up data.

Financial analysts work closely with the accounting team to ensure accurate financial reporting. They make comparative analysis and are sometimes in charge of increasing productivity by developing automated accounting applications.

They maintain their technical knowledge by keeping up with trends and attending workshops and also contribute to team effort by accomplishing results, as needed by the company.

Responsibilities of a financial analyst:

- Provide analytical support

- Perform financial reporting and forecasting

- Analyze financial data and produce monthly reports, including key metrics and financial results

- Identify financial status

- Guide cost analysis processes

- Determine cost of operations by collecting operational data

- Maintain databases by entering, verifying, and backing up data

- Work closely with the accounting team to ensure accurate financial reporting

- Make comparative analysis

- Increase productivity by developing automated accounting applications

- Maintain their technical knowledge by keeping up with trends and attending workshops

- Contribute to team effort by accomplishing results

Find financial analyst projects here

Skills

Financial analysts have strong knowledge of corporate finance and have high proficiency in financial modeling techniques and quality management. They also have a strong understanding of how economic trends, policies and regulations may affect investments.

They are skilled at cost accounting, financial planning and reporting, and have a strong fluency with Excel formulas and functions.

These analysts have good computer skills and are able to effectively use relevant software to analyze financial information, establish portfolios and make forecasts.

They have strong decision-making, data gathering and analytical skills and have excellent attention to accuracy and detail. They also have strong math skills as well as verbal and written communication skills.

What are the top 3 skills for financial analysts? The top 3 skills needed to work as a financial analyst would be – knowledge of corporate finance, knowledge of financial modeling and modeling and finally, strong analytical skills.

Skills of a financial analysts:

- Strong knowledge of corporate finance

- High proficiency in financial modeling techniques and quality management

- Strong understanding of how economic trends, policies and regulations may affect investments

- Good computer skills

- Ability to effectively use relevant software to analyze financial information, establish portfolios and make forecasts

- Strong decision-making skills

- Ability to gather data

- Strong analytical skills

- Excellent attention to accuracy and detail

- Strong math skills

- Excellent verbal and written communication skills

Join our IT freelancer community today! Create your freelance profile in just 2 minutes.

Background

How do I become a financial analyst? To work as a financial analyst, you need to have at least a Bachelor’s degree. This can be in the field of Mathematics, Statistics, Finance, Economics, Accounting, or a related field. Some employers may also require you to have a Master’s degree.

Certifications can also improve the chances of being hired or promoted. Options for these are as follows:

- Learn to be a Financial Analyst

- Financial Analysis for Credit

- Become a Certified Financial Modeling & Valuation Analyst (FMVA)®

- Finance & Quantitative Modeling for Analysts Specialization

Looking for a freelance financial analyst?

Find the right one here

Salary

Is financial analyst a good career? Financial analysts can earn quite a bit of money, making this a good career choice for many. Those who are just starting out can expect to earn around $51,000 whereas those with years of experience and skills can earn around $107,000 per year. The average salary for financial analysts is $73,725 per year.

In the UK, the salary range for analysts is £28,000-£70,000 whereas in Germany, the range is €45,000-€104,000.

Salary of a financial analyst:

| Junior | $51,000 |

| Average | $73,725 |

| Salary | $107,000 |

Salary range of financial analysts:

| US | $51,000 – $107,000 |

| UK | £28,000-£70,000 |

| Germany | €45,000-€104,000 |

How much do freelance financial analysts earn?

Blazor developers on freelancermap charge on average:

Rates in this field range between $33 and $106/hour for most freelancers.

The daily rate for Blazor developers (8 working hours) would be around:

Financial analyst job description template

If you’re looking for an expert who can take care of your financial data, here’s a useful job description template that will help you find the perfect analyst:

We are looking for a financial analyst who can forecast future revenue and expenditures ato help predict future results and drive process and policy improvements. Your primary job will be to provide analytical support, perform financial reporting and forecasting, and analyze financial data.

Responsibilities:

– Provide analytical support

– Perform financial reporting and forecasting

– Analyze financial data and produce monthly reports

– Identify financial status

– Guide cost analysis processes

– Determine cost of operations by collecting operational data

– Maintain databases by entering, verifying, and backing up data

Skills:

– Strong knowledge of corporate finance

– High proficiency in financial modeling techniques

– Experience with quality management

– Strong understanding of how economic trends, policies and regulations may affect investments

– Good computer skills

– Ability to effectively use relevant software

– Strong decision-making skills

– Excellent attention to accuracy and detail